The Coalition Government promised before the federal election to help first homebuyers get into the housing market. That help is the First Home Loan Deposit Scheme. Instead of saving for years to get a 20% deposit, you could buy your first property sooner with the Government acting as your guarantor.

As good as it may sound, this route to home ownership comes at a cost: almost an extra $53,000, according to property portal Domain.

Under the program, you can buy your first home with a deposit as low as 5% of the property’s value if you earn up to $125,000 a year ($200,000 for couples). The Government would pay the lenders mortgage insurance (LMI), which banks typically require for any deposit below 20% of the home value. This could mean a saving of around $10,000.

The scheme, set to kick off in January 2020, would help up to 10,000 of the estimated 100,000 first-time buyers each year. There would be a limit on the value of the property you could buy based on your region. But details have yet to be released.

What’s the cost?

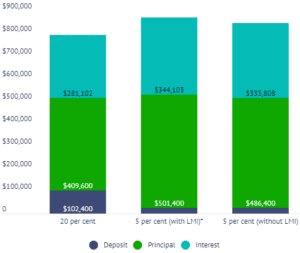

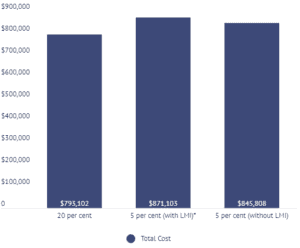

The scheme could substantially cut the time it takes to save for a deposit and get into the market. If you’re an average first homebuyer in Sydney, you could buy a home 4.8 years earlier with a 5% deposit than with a 20% deposit, research by Domain shows. However, as the charts below illustrate, you would have to pay an extra $53,000 over the life of your loan, mainly because of interest.

Total housing costs in three mortgage scenarios

Breakdown of costs

Total cost

Assumptions:

- An entry-level house price for combined capital cities (excluding Darwin) of $512,000

- A discounted variable mortgage rate of 4.61%

- A principal and interest first homebuyer loan

- No monthly fees

- Monthly repayments

- A loan term of 25 years

- *LMI costs of $15,000, capitalised over the full term of the loan

- Stamp duty, conveyancing and other costs excluded.

Source: Domain with data from the Australian Securities and Investments Commission

Using a 4.61% interest rate, Domain estimates that a 5% deposit without LMI would require you to fork out a total of $845,808. That is significantly more than the $793,102 you would pay with a 20% deposit.

Having just a 5% deposit means you would be taking on more debt – and increasing your risk of falling behind in your repayments if your circumstances change. This goes against the more prudent lending practices regulators have tried to encourage in recent years, according to Domain research analyst Eliza Owen.

Don’t get caught up in the frenzy

Even before Domain crunched the numbers, analysts and some property industry members had warned against using the scheme.

The Real Estate Buyers Agents Association (REBAA) had said that first-time buyers could get caught up in the rush to take advantage of the scheme and fail to research the market properly.

“It’s all well and good to jump on the property ladder as long as the ladder isn’t leaning on the wrong wall in the wrong suburb,” said REBAA president Rich Harvey.

Falling house prices could disadvantage homebuyers using the scheme, according to economist Saul Eslake. “In a market where prices appear to be falling, there’s a risk that someone who enters this scheme may find themselves in a negative equity position,” he said in a recent report.

As of May 2019, national house prices had tumbled 8.2% since their peak in October 2017. It remains unclear when the market will bottom out.

Know your options

Before you decide to use the scheme, it’s important to do your research and understand the risks. Importantly, know your options.

“As a first-time buyer, if you get it wrong, it can be a very long and protracted process to get out of, but if you get it right, it can set you up for life,” said Harvey.