Small and medium-sized enterprise (SME) owners are struggling with dwindling cash reserves amid soaring inflation and cost-of-living pressures.

According to a recent survey commissioned by Prospa, 22% of participating entrepreneurs have no cash reserves, and 18% rely on funds covering less than a month’s expenses. About one in five expects to deplete their cash reserves within one to two months.

“The current economic conditions are such that small businesses are getting further away from the three to six months’ cash reserves recommended to cover operating expenses,” says Prospa Co-Founder and Chief Revenue Officer Beau Bertoli.

Retail and hospitality industries struggle

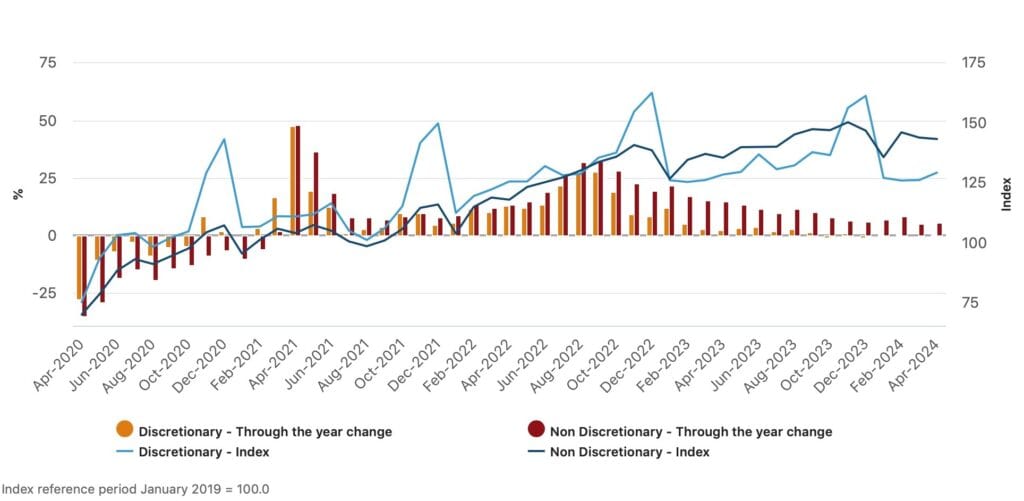

Reduced consumer spending – along with supply chain cost increases and rising energy expenses – has hit many small businesses hard. Data from the Australian Bureau of Statistics shows that in the year to April 2024, household discretionary spending rose by only 0.6%, compared to 5.8% in non-discretionary categories. This followed a period of no growth in discretionary spending in the year to March 2024.

Retail and hospitality businesses are some of the most affected. Official data reveals that retail sales fell by 0.4% in March 2024, after a small increase the previous month. In the hospitality industry, the impact of pressure on household budgets has led to a spate of business closures.

The situation is so severe that digital credit agency CreditorWatch predicts one in every 13 Australian hospitality businesses could fail within the next 12 months.

Figure 1: Household discretionary and non-discretionary spending

Source: Australian Bureau of Statistics, Monthly Household Spending Indicator, April 2024

Squeeze on personal finances

Personal sacrifices have become common among SME owners dealing with financial challenges. About four in five admitted to experiencing financial strain, with 46% opting to reduce their own incomes to cope with rising costs and 31% using their personal savings for their businesses.

These economic hardships have taken a toll on the quality of life and wellbeing of SME owners. According to the Prospa survey, 44% of respondents reported increased stress or burnout. Almost a third said they have less time for personal relationships and leisure activities as they focus on their businesses.

Adapting strategies

Despite challenges, Australian SMEs remain largely resilient, with around four in five indicating they have or plan to adopt strategies to combat rising costs in the coming year. This includes increasing support for technology adoption to help streamline operations and improve efficiency.

Cost-cutting measures also remain a priority for SMEs, with many planning to reduce non-essential expenses and roll out price increases to boost profitabiliy.

Importance of funding and broker support

Quick and accessible funding solutions are critical for struggling businesses, according to Roberto Sanz, Prospa’s General Manager of Sales and Partnerships.

“In today’s macro-economic climate where small businesses have little to no cash reserves, gaining fast access to additional funding can be critical to ensuring business continuity and success,” he says.

Sanz also emphasised the important role of brokers in supporting SME resilience.

“As businesses adapt to the changing [economic] climate, they’re increasingly seeking advice from brokers to navigate alternative funding options and gain access to the cash boost they need,” he adds. “By providing tailored and thoughtful solutions to their clients, brokers will enable SMEs to weather the storm and drive profitable growth.”