Australia’s housing market downturn is starting to affect small and medium-sized enterprises (SME’s). The common practice of using home equity to finance a business has now put many SME’s at risk as house values continue to decline.

The Australian housing boom has allowed many homeowners to start and fund businesses using loans secured by their homes. Data from the Reserve Bank of Australia shows that more than half of collateralised small business lending is secured by housing.

But what has allowed many businesses to remain solvent may now cause many of them to fail as property values fall and interest rates go up, according to business recovery specialists Jirsch Sutherland.

“Any business that has used personal finances for business borrowings is now at risk,” says Trent Devine, Partner at Jirsch Sutherland. “That’s because we now have an environment where property prices are falling, which means reduced levels of equity with which to finance or prop up a business.”

House prices still falling

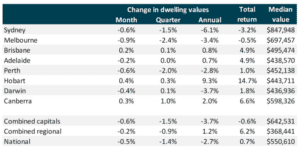

Australian home prices declined for the 12th consecutive month in September 2018. They dropped 0.5% during September and are 2.7% below their peak 12 months ago, data from CoreLogic shows.

ANZ expects national home values to drop by 4% in 2018, driven by price falls in Sydney and Melbourne. CoreLogic data for September 2018 shows that Sydney house prices have dropped 6.1% over the past 12 months; in Melbourne, prices are down by 3.4%.

The pressure on business owners relying on their home equity is set to increase, as house prices are expected to continue to fall in 2019. ANZ has forecast home prices to decline by 2% in 2019, mainly due to tighter lending standards.

Figure 1: Home value index of Australian capital cities, September 2018

Businesses in financial distress

The downturn in the housing market has led to an increase in ‘small business stress’ over the past 12 months, according to Devine.

Research from insolvency firm SV Partners shows that 55% of businesses at high to severe risk of financial failure in the next 12 months are smaller enterprises (those with an annual turnover between $1 million and less than $10 million). Businesses at high to severe risk of financial failure are ‘extremely likely’ to go through a serious adverse event within the next 12 months – including external administration, a petition to wind up, a court judgment or writ, a payment default or a mercantile enquiry.

Figure 2: Top three industries with businesses[1] at high to severe risk of financial failure in the next 12 months

Keeping business finances separate

Devine believes the risk to SME’s presented by the housing market downturn can be attributed to the “ill-advised” mixing of personal and business finances. Many SME owners use their home as collateral for business loans because they typically have the same bank for their business and personal finances.

Banks generally prefer physical assets such as property as loan security because of the higher risk associated with small enterprises. For many entrepreneurs, putting up their home as collateral is the only way to secure financing from banks.

Devine says it’s important for entrepreneurs to keep their personal and business assets separate, and to use different banks for their business and personal finances. “Removing a house as a security measure as the business gets stronger is also a good idea. However, that might be a difficult thing to do right now,” he adds.

But it’s not only falling home values that are threatening small businesses. Mortgage stress from other factors such as rising interest rates may also affect the ability of owners to sustain their businesses, according to Devine.

“If a business is struggling, banks might note that there’s now no property to support that business because the mortgage is under stress,” says Devine. “Clearly, this means that business insolvency becomes a strong possibility.”