Are Australians spending their savings from lower consumption and early super withdrawals on online shopping and gambling, as reports claim? A new analysis shows many are actually using their money to pay off mortgages faster instead of spending on goods or services.

According to data from non-bank lender Firstmac, voluntary mortgage repayments more than doubled in the third quarter of 2020 compared to the prior year. An analysis of its almost $6 billion retail home loan book found that mortgagors’ voluntary payments reached an average of 10.2% of the portfolio in July, August and September. This was more than twice its monthly average payment of 4.8% in the previous 12 months.

This contrasts with the doom and gloom predictions of mass mortgage defaults as stimulus packages and repayment holidays wind up. According to a recent prediction, more than 102,000 households were at risk of defaulting on their home loans in the coming months.

“There’s obviously a lot of money flowing through the economy and people are choosing to save that money,” Firstmac Chief Financial Officer James Austin said in an interview. “Paying down the mortgage is another form of saving.”

Uncertainty remains

However, Austin acknowledged that paying back loans faster suggests borrowers are feeling uncertain about the future.

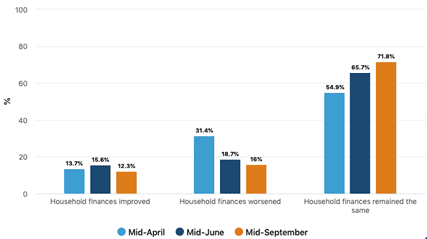

An Australian Bureau of Statistics survey conducted in September found that almost half of Australians (49%) had neither reduced their debt nor increased their savings since COVID‑19 restrictions started in March. Only one in seven (15%) respondents trimmed their debt and grew their savings. For the majority, their household finances had remained the same.

Figure 1: Change in household finances due to COVID-19

In contrast, Australia’s national accounts for the March to June 2020 quarter show that the household savings ratio jumped to 19.8% from 6.0% the previous quarter. This was the highest rate since June 1974, and was driven by a large fall in consumption, according to the Australian Bureau of Statistics. Australians have not been able to spend on their usual activities, such as eating out, drinking at pubs and travelling, since the government rolled out COVID-19 restrictions.

The growth in savings was consistent with the $33.4 billion increase in household cash held in term deposits and savings instruments in the March to June 2020 quarter.

Besides the drop in spending, AMP Capital attributes the lift in savings to a temporary boost to income from government payments and other support measures such as the early super access scheme and mortgage repayment holidays.

The higher savings rate can smooth consumption and support households’ ability to service their loans.

“The current rise in savings will be necessary to offset any forthcoming weakness in income from declining government support payments,” says Diana Mousina, an economist at AMP Capital.

Delayed spending

But households might eventually ramp up spending. According to AMP Capital chief economist Shane Oliver, consumers will likely spend on goods and services they had to delay purchasing because of COVID-19.

“There will come some point in the next six to 12 months when people will say, ‘It looks like I’m going to keep my job after all. We’re starting to get [the] coronavirus under control. I’ve got my mortgage to a lower level, so I might as well go out and buy a car or go on holiday’,” says Oliver.