Many Australians are struggling with the cost-of-living crisis, yet average wealth per adult is rising. By 2028, approximately 400,000 more Australians are expected to join the ranks of the fewer-than-2-million millionaires currently in the country, thanks largely to surging property values.

This suggests a growing market of potential high-net-worth clients for mortgage and finance brokers.

The latest Global Wealth Report from UBS shows that between 2008 and 2023, average wealth in Australia surged by 150% to reach more than A$807,000, and median wealth grew by 110% to over A$387,000.

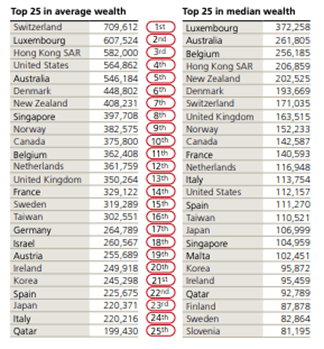

In 2023, Australia’s average wealth per adult grew at more than double the rate of the UBS sample of 56 countries, placing it fifth overall. It ranked second only to Luxembourg in median wealth per adult.

The country also boasts one of the highest proportions of millionaires per capita, with nearly 10% of adults qualifying as millionaires.

Figure 1: Top 25 countries in average and median wealth, 2023 (US dollar)

Source: UBS 2024 Global Wealth Report

Property as a major source of wealth

Much of Australians’ wealth comes from their property holdings and decades of rising home values.

According to data from CoreLogic, housing values rose by 382% over the past 30 years, reflecting a compound annual growth rate of 5.4%. Capital cities particularly surged, with combined values increasing by 409%.

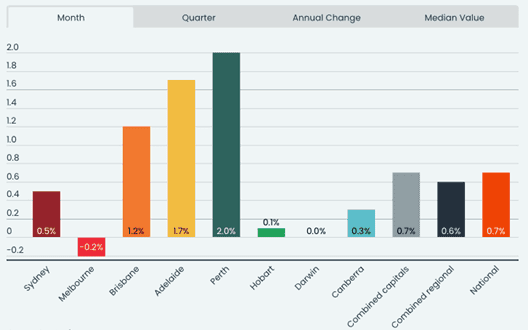

Figure 2: Australian housing values, June 2024

Source: CoreLogic Home Value Index, 30 June 2024

In FY2023–24 alone, housing prices across the country rose by 8%, delivering an A$59,000 wealth boost to the median dwelling value.

According to CoreLogic Research Director Tim Lawless, tight supply levels are driving resilience in the housing market and putting upward pressure on values.

“The persistent growth comes despite an array of downside risks including high rates, cost-of-living pressures, affordability challenges and tight credit policy,” he says.

This upward trend suggests significant future wealth accumulation for property owners.

“If [someone is] a typical homeowner, if they’ve paid off their loan, they’re going to be almost by default a millionaire in the not-too-distant future because the median house price is already getting around that level,” says Professor Roger Wilkins, Deputy Director of the Melbourne Institute of Applied Economic and Social Research.

Impact of generational wealth transfer

A substantial wealth transfer from Australian baby boomers is also expected to accelerate wealth accumulation.

Typically classified as those born between 1946 and 1964, Australian baby boomers hold about A$4.9 trillion in wealth. Griffith University researchers estimate that Australians will inherit approximately A$3.5 trillion from this generation over the next 20 years. Each recipient is expected to receive about A$320,000 on average.

This wealth transfer could significantly boost Australia’s economy while driving property prices even higher.

“Unfortunately, there is a very low level of supply of housing at the moment,” says Johnathan McMenamin, a Senior Economist at financial services company Barrenjoey. “And so, when your marginal buyer in the housing market has access to inherited wealth, then the price of that house can lift quite substantially.”