Interest rates have hit historic lows and home prices are bouncing back. But housing credit remains beyond the reach of many Australians, creating opportunities for mortgage brokers to help would-be borrowers.

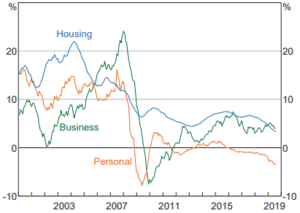

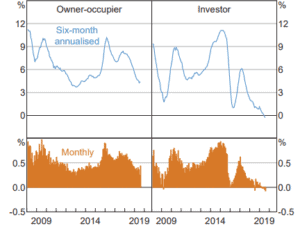

A recent survey by CoreLogic shows Australians are still finding it hard to get home loan approvals. About 45% of respondents identified the difficulty of getting credit as a barrier to buying a home, up from 39% in 2017. In fact, housing credit grew at an all-time annual low of 3% in October – down from 5% a year ago. Growth in investor housing credit has stalled, expanding at just 0.2% year on year.

“The severe tightening of credit availability following stronger prudential regulation and outcomes related to the banking Royal Commission is hurting Australians, who are struggling to get a loan,” said CoreLogic Research Director Tim Lawless. “Lenders also have a greater focus on evaluating and assessing individual borrower’s expenses.”

Figure 1: Credit growth by sector, by each year’s end

Figure 2: Housing credit growth as at end of August 2019

Too Scared to Lend

Major banks continue to be very cautious about lending, even though it has been years since the introduction of tougher prudential rules.

In December 2014, the Australian Prudential Regulation Authority (APRA) set a 10% limit on banks’ investor lending growth and required them to assess applicants’ serviceability by using interest rates of 7% or more. It then introduced a 30% cap on the share of interest-only home loans as a percentage of banks’ new mortgages in March 2017.

APRA has since scrapped these rules. But it continues to require banks to more closely scrutinise loan applicants’ incomes and living expenses, which analysts believe is having more serious consequences for prospective borrowers. Banks must also follow the Australian Securities and Investments Commission’s responsible lending rules.

Tighter scrutiny of living expenses – from Uber rides and Netflix subscriptions to travel spending – puts applicants through rigorous and often drawn-out application processes. For some, this means failing to make the cut.

Policymakers have acknowledged that major banks have gone overboard in fulfilling their responsible lending obligations. Reserve Bank Governor Philip Lowe recently said that though banks’ lending standards have been strengthened, “in some areas the pendulum may have swung a bit too far”.

“Lenders should not be so scared of making a loan that goes bad that they don’t provide the credit that the economy needs,” said Lowe at the Reserve Bank Board dinner in October.

Credit Growth Expectations

How long might the credit squeeze go on? Westpac expects housing credit growth to increase to 3.5% by September 2020. Commonwealth Bank of Australia also has positive expectations of lending growth as the November 2019 data from its Household Spending Intentions series shows a sharp increase in home-buying intentions.

“The sharp upswing in home-buying intentions continues and intentions are now approaching the record highs seen in early 2017,” said Commonwealth Bank Chief Economist Michael Blythe.

But even with more people intending to buy property, and prices trending upwards in major markets such as Melbourne and Sydney, stringent requirements and processes for applying for housing loans remain. Banks are expected to continue scrutinising the financial circumstances and living expenses of would-be borrowers, as APRA requires.

“The changes being finalised today are not intended to signal any lessening in the importance APRA places on the maintenance of sound lending standards,” said APRA Chair Wayne Byres in announcing the axing of the 7% interest rate rule in July.

As major banks make getting credit doubly difficult, more would-be borrowers are turning to smaller banks and other lenders. Analysis by Morgan Stanley shows that housing loans grew 16% for non-banks and 8% for smaller banks in the 12 months to April 2019. In contrast, major banks’ mortgages collectively expanded at 2.3% year on year.

“Major banks face a competitive disadvantage and are likely to see further market share losses in mortgages,” said Morgan Stanley.