Mortgage arrears are on the rise at major Australian banks, reflecting the increasing financial strain on households from the high cost of living and interest rates.

According to Westpac’s latest financial results, its overall Australian mortgage delinquencies climbed by six basis points to 1.12% in the three months to June 2024. Likewise, the rate of mortgages overdue by more than 30 days rose to 1.90%.

Westpac CEO Peter King acknowledged that some customers are struggling to meet their financial obligations.

“The cost of living and high interest rates remain a challenge for some customers while many businesses are facing cost pressures and experiencing lower demand,” said King. “We encourage customers to call us if they need help.”

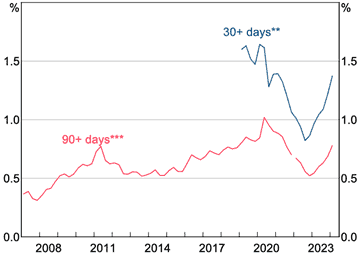

Figure 1: Housing loan arrears rates among owner-occupiers (share of loan balances by days past due)

Source: Reserve Bank of Australia July 2024 Bulletin

Similarly, the Commonwealth Bank of Australia reported that housing loan arrears of 90 days or more reached 0.65% of its portfolio for the financial year ending June 2024. This was up by 18 basis points from the previous period and marked the bank’s highest arrears rate in three years. However, Commonwealth Bank noted that the figure was still equivalent to its historical average from 2008 to 2023.

“Our home lending portfolio remains well secured, and the majority of home lending customers remain in advance of scheduled repayments,” said the bank’s financial report.

Non-performing loans rise

NAB also reported an increase in non-performing loans, which rose by 11 basis points to 1.31% during the June 2024 quarter.

NAB CEO Andrew Irvine noted that the economic environment, including inflationary pressures, has been challenging for the bank’s customers.

“While most customers are proving resilient, not unexpectedly we have seen asset quality deteriorate further in 3Q24,” he said.

Maintaining financial stability

According to the Reserve Bank of Australia (RBA), housing loan arrears have been rising steadily since late 2022. This is driven by challenging macroeconomic conditions and the gradual ageing of the loan pool.

“Highly leveraged borrowers have been most likely to fall into arrears since 2022, consistent with their generally higher arrears rates and greater vulnerability to challenging economic conditions,” said a central bank report.

Despite expected further increases in mortgage arrears, RBA’s analysis suggests that risks to financial stability remain contained. “Banks are well placed to withstand increased loan losses, supported by their previous provisioning [and] strong profits and capital positions,” added the report.

With rising arrears rates, mortgage brokers should proactively review clients’ repayment options and walk them through choices, such as negotiating better rates or refinancing. It’s important to keep clients informed about their options and available support.