An environment of increasing interest rates

After raising the cash rate seven times in a row, the Reserve Bank of Australia now expects home loan payments to reach record levels. However, not every borrower is in for a mortgage shock as many are still ahead on their repayments.

According to the RBA, home loan payments are set to rise further “as a result of the increase in home loan interest rates” already seen over 2022.

“This included the effect of fixed interest rate loans rolling off over time,” said the central bank in its November board meeting. It expects the cumulative increase in interest rates to force mortgage payments as a share of household income to reach levels not seen since 2010.

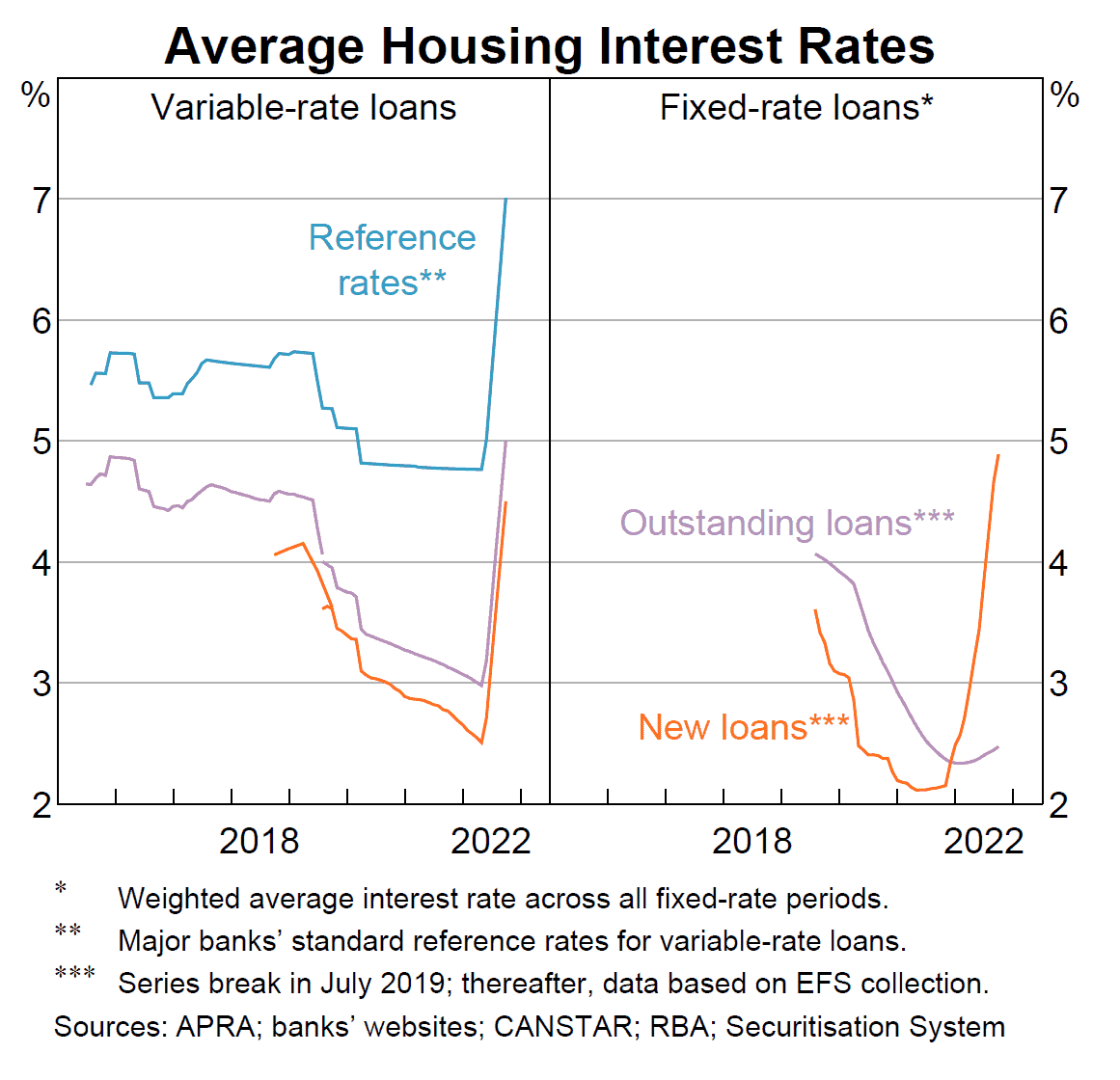

The RBA has so far hiked the official cash rate seven times this year to 2.85% in November. This has driven up the average variable housing loan rates from around 2% to about 5%.

Figure 1: Australia’s average housing interest rates

Source: Reserve Bank of Australia November Chart Pack,, November 2022

The good news is that many Australian borrowers are still ahead on their housing loan repayments, providing some cushion to the impacts of continued rate rises.

“Payments into offset and redraw accounts were still high, but somewhat less over 2022 than the preceding year,” noted the RBA.

Around 70% of ANZ’s home loan variable rate customers, for example, had accelerated payments as of October 2022. “And of that 70%, a half of them are more than two years ahead,” said ANZ CEO Shayne Elliott in a recent interview.

“As interest rates rise for many of those customers, nothing changes,” added Elliott. “As of today, people who are under stress with home loans that are 90 days past due are beginning to fall. So we have not yet seen a pickup in distress.”

Borrowers to feel impact of higher rates

Westpac has likewise not seen a spike in financial hardship or stressed assets among its home loan borrowers.

“Many customers built up savings during the past two years, and 68% remain ahead on their mortgage repayments,” said Westpac Chief Executive Peter King.

But this is bound to end for some borrowers as interest rates look set to rise further. Economists expect the central bank to hike the cash rate by another 25 basis points in December as it fights stubborn inflation, which reached a 32-year high of 7.3% over the 12 months to September 2022.

“The RBA will likely want to see more of a tapering in demand to avoid a sharp breakout in wage growth,” said Sean Langcake, Head of Macroeconomic Forecasting at BIS Oxford Economics. “We expect to see a further 75 basis points of tightening before the RBA pauses the current rate hiking cycle.”

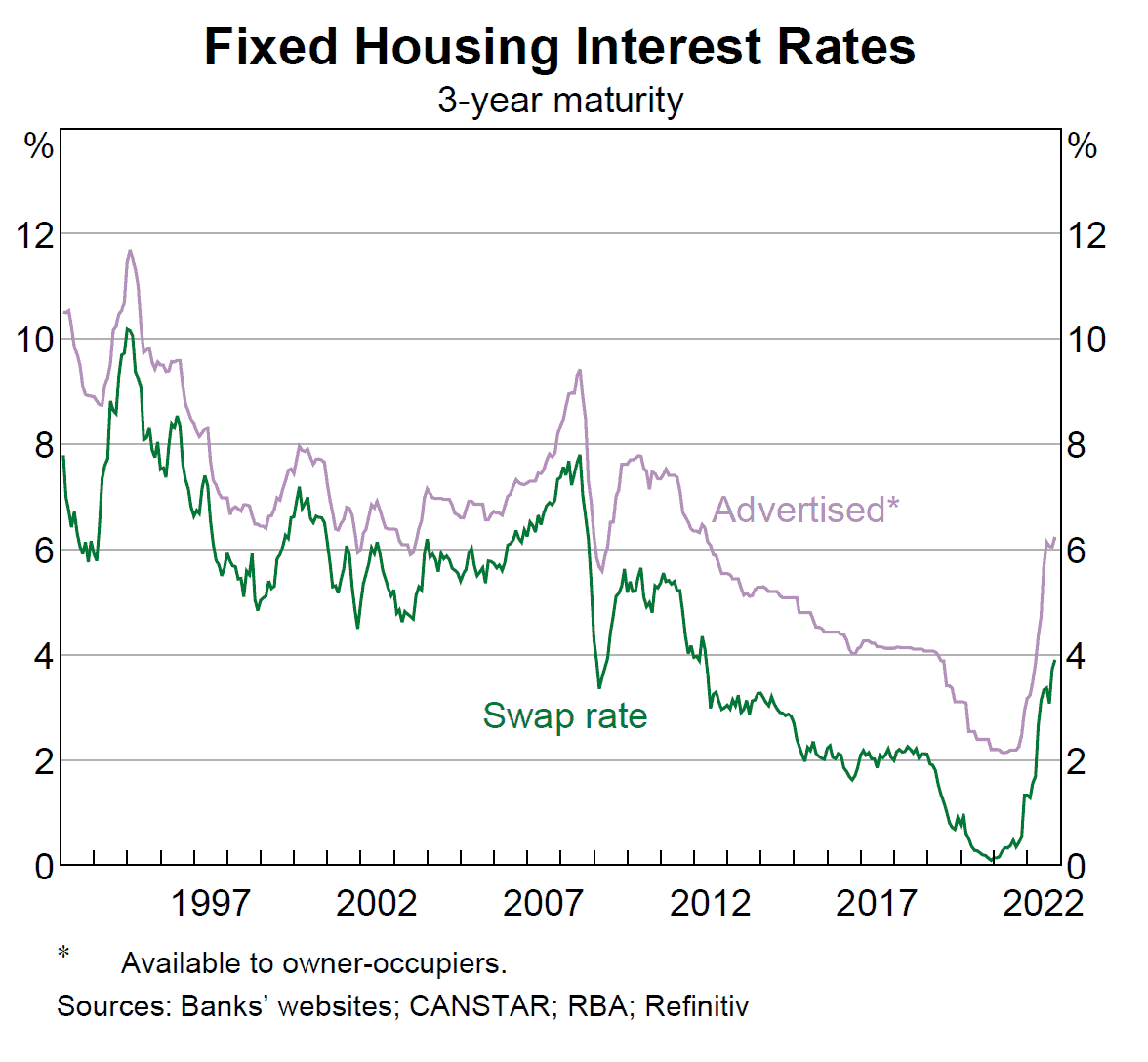

Customers with fixed rate mortgages are expected to bear the brunt of further rate rises as their fixed terms end.

“It is inevitable that the impact of higher rates will be felt,” said King.

Figure 2: Fixed housing interest rates (three-year maturity)

Source: Reserve Bank of Australia November Chart Pack,, November 2022

A potential rise in arrears

While home loan delinquencies over the 12 months to May 2022 fell in most Australian states, Moody’s predicts an increase in mortgage arrears over the next year as rising interest rates and cost of living and falling property prices bite.

“Falling house prices will increase the risk of home loan delinquencies and defaults, because a weakening housing market will make it harder for borrowers in financial trouble to sell their properties at high enough prices to repay their debt,” said Moody’s.

For mortgage brokers with clients who might struggle to meet repayments, now is a good time to speak to them and walk them through their options. Perhaps they can negotiate for better mortgage rates? Or is refinancing their best option?