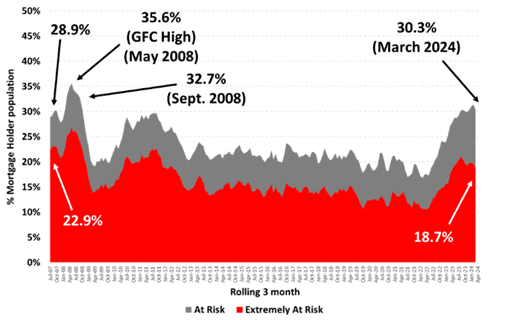

With interest rates staying elevated following a year of aggressive increases, mortgage stress is on the rise among borrowers.

New data from Roy Morgan reveals that the number of Australians facing mortgage stress has increased by 724,000 since May 2022, when the Reserve Bank of Australia (RBA) began raising the cash rate from a record low of 0.10%. This brings the total number of mortgage holders at risk of financial stress to over 1.5 million in the three months to March 2024.

That’s 30.3% of all Australians with a mortgage.

“The figures take into account 13 rate increases, which raised interest rates by a total of 4.25 [percentage] points to 4.35%,” says Michele Levine, CEO of Roy Morgan.

Figure 1: Mortgage stress levels among owner-occupied mortgage holders

Source: Roy Morgan, Mortgage stress report, March 2024

Interest rate sensitivity

Sharp rate rises have driven up debt servicing costs for many mortgage holders.

According to a recent report by the International Monetary Fund (IMF), Australian households are particularly sensitive to interest rate hikes compared to other countries. This is largely due to the prevalence of variable rate mortgages, suggesting a stronger direct relationship between changes in monetary policy and housing markets.

“Countries such as Australia and Japan appear to have stronger housing channels of monetary policy transmission, with low shares of fixed-rate mortgages, less-restrictive loan-to-value limits, high household debt (only to some extent in Japan) and a somewhat elevated proportion of the population living in housing-supply-restricted areas,” says the IMF.

Roughly 70% to 80% of mortgage holders in Australia are on variable rates, and the ratio of household debt to GDP is one of the highest globally at more than 110%.

This highlights the increased vulnerability of Australian households to interest rate fluctuations, contributing to financial strain.

Reduced pressure with increased income

The good news is that in March, the number of Australians at risk of mortgage stress dropped by 98,000 compared to the previous month, following the RBA’s third consecutive decision to maintain the cash rate.

As Levine notes, the pause in rate hikes over the five months since November 2023 has eased pressure on borrowers and spurred growth in various sectors of the economy.

“Rising household incomes so far this year have been a significant driver of reducing mortgage stress from the highs above 1.6 million reached in recent months,” she says.

Rising unemployment poses concern

Despite this improvement, concerns linger. Roy Morgan’s unemployment estimates for March reveal that nearly one in five Australian workers are either unemployed or underemployed, totalling more than 2.9 million individuals.

This figure marks a significant increase of 205,000 compared to the previous year.

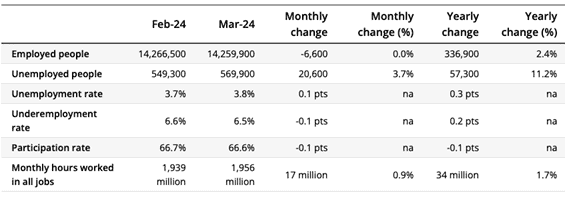

Likewise, data from the Australian Bureau of Statistics (ABS) shows a 0.1 percentage point increase in March’s seasonally adjusted unemployment rate.

“With employment falling by around 7,000 people and the number of unemployed rising by 21,000 people, the unemployment rate rose to 3.8%,” says Bjorn Jarvis, Head of Labour statistics at ABS.

Figure 2: Seasonally adjusted employment rate, March 2024

Source: ABS, Labour Force, Australia

The decline in employment, coupled with the growth in Australia’s population, led the seasonally adjusted employment-to-population ratio to drop by 0.2 percentage points to 64%.

Despite the current attention on inflation and its potential impact on future interest rates, Roy Morgan emphasises that employment continues to be the main driver of mortgage affordability.

“The fact remains that the greatest impact on an individual, or household’s, ability to pay their mortgage is not interest rates. It’s if they lose their job or main source of income,” it says.