Remember the dire predictions of a flood of business failures this year? They’re not likely to happen – at least not anytime soon, according to some experts.

Last year, economists warned of a rising number of ‘zombie’ businesses kept alive by government measures, and how the end of such support could trigger massive insolvencies. Now, CreditorWatch says the predicted wave of small and medium-sized enterprise (SME) failures is unlikely. While the credit agency expects a rise in insolvencies this year, it believes that even firms saddled with debts will have opportunities to turn their business around.

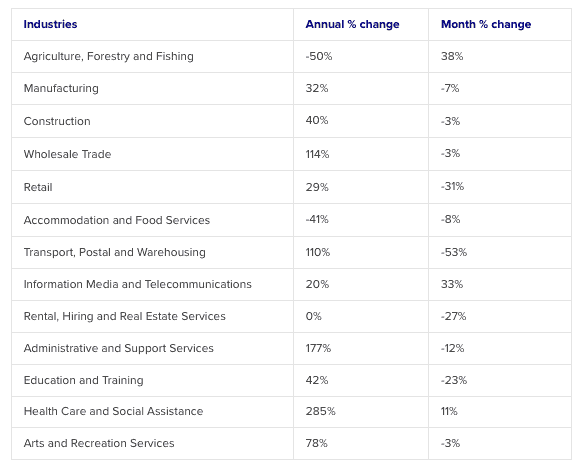

CreditorWatch’s recent report shows 15 out of 19 Australian industries experienced reduced payment times in December 2020. Business payment defaults also dropped 8% on a monthly basis and 45% annually.

Reduced payment times signal improved cash flow among SMEs. According to CreditorWatch CEO Patrick Coghlan, it reflects better economic conditions at the end of 2020.

“There’s a lot of potential for a quick recovery, similar to that experienced in the middle of 2020 when the original lockdowns were removed,” said Coghlan. “Sectors such as accommodation and food services could demonstrate a strong comeback when existing restrictions and border closures are put to bed.”

Figure 1: Change in the number of days business payment was overdue by industry, December 2020

No widespread insolvencies

CreditorWatch data shows external administrations dropped more than 32% annually in December. But this was chiefly due to a moratorium on insolvent trading.

In March 2020, the government introduced legislation increasing the threshold at which creditors can initiate bankruptcy proceedings and protecting company directors from personal liability for insolvent trading. This helped struggling businesses stay afloat at the height of the COVID-19 crisis.

The insolvency relief measures ended on 31 December, and CreditorWatch now predicts a rise in the number of companies entering voluntary administration this year. Still, it doesn’t expect an immediate avalanche of business failures.

“It is yet to be seen whether the pattern of insolvencies will be orderly, sporadic or volatile, but it appears we are not headed for a steep cliff of business failures, which are likely to take time to feed through the system,” said CreditorWatch Chief Economist Harley Dale.

Insolvencies to be less diffused

CPA Australia spokesperson Jane Rennie expects insolvencies to be more concentrated in certain sectors.

“Small tourism operators are potentially looking down the barrel of months of rolling border closures. They’re likely to be at the top of the list of businesses which may close their doors permanently,” said Rennie.

“CBD-based hospitality and retail businesses are likely to experience delays in the return of city workers and reduced traffic volumes longer-term, making them another at-risk sector.”

COVID-19 threats remain

Recent COVID-19 outbreaks also point to the continuing uncertainty and economic volatility businesses must deal with this year.

CreditorWatch warns that ongoing lockdowns and border closures could derail economic recovery.

“A fresh outbreak of COVID-19 on the Northern Beaches in Sydney in December 2020 manifested into varying degrees of restrictions across Greater Sydney,” said Dale. “A three-day hard lockdown for Brisbane was the final crush and thousands of businesses on the eastern seaboard, having jumped back into the things they do best, found they had to close again or restrict activity.”

He urges struggling businesses to work with advisers and start negotiating with their creditors.

“That’s going to be the best way to continue trading even through difficult economic periods. Insolvency is not inevitable.”