Prime Insights

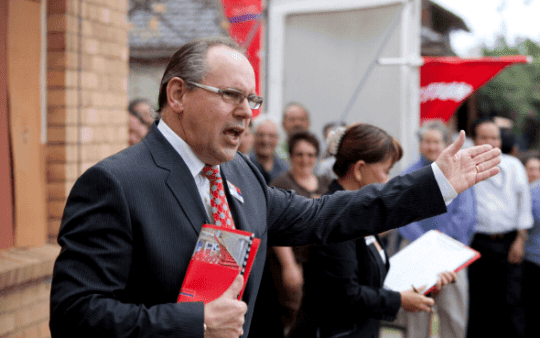

Is 2020 a Boom Year for the Housing Market?

A year ago, Australian housing prices were mostly in freefall. Economists predicted them to dive by as much as 25%…

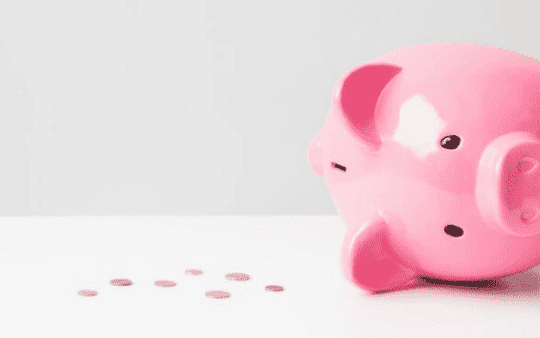

Bank Credit Remains Elusive

Interest rates have hit historic lows and home prices are bouncing back. But housing credit remains beyond the reach of…

What’s Behind The Rebound In Home Prices?

Housing prices are rising again. In October, national home values rose 1.2%, the largest monthly increase in more than four…

Older Australians Face Debt And Distress

More older Australians are carrying the heavy burden of mortgage debt into retirement, causing them psychological distress. This suggests a…

Mortgage Debt Is Drag On Economy

Australia has one the world’s highest levels of household debt, and research shows that adults who have fallen behind on…

Use Your Banking Data to Your Advantage

Open banking is here, having kicked off its first stage on 1 July 2019. But what does it mean for…

Time To Worry About Rising Mortgage Arrears?

The number of Australians behind in their mortgage repayments is higher than it has been since the fallout from the…

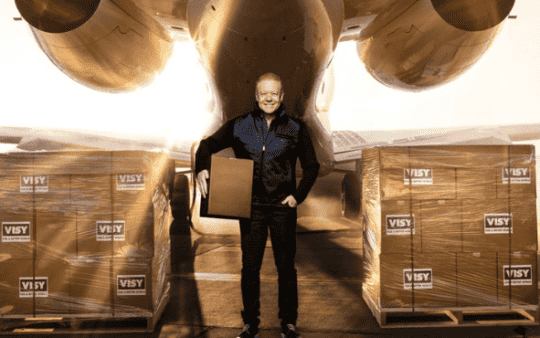

Tech is Now the Fastest Route to Riches

Australian property developers seem to be surviving the housing slump quite well. According to The Australian Financial Review 2019 Rich…

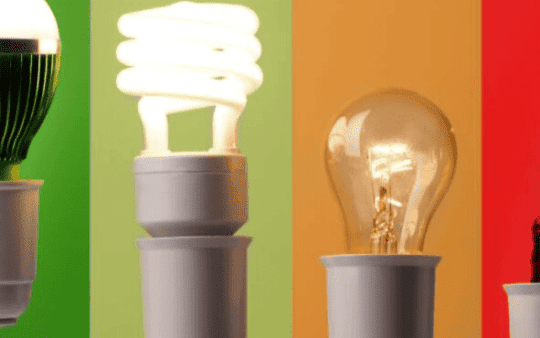

More Rate Cuts Are Coming, But Are They Effective?

Australia’s official cash rate is now down to 1%. And if we are to believe one prominent economist, it could…

A Quick But Expensive Fix?

The Coalition Government promised before the federal election to help first homebuyers get into the housing market. That help is…