Housing stress is not new to Australians, but the COVID-19 pandemic has made it more severe. Research shows the number of people who can’t pay their rent or mortgage instalments on time has more than doubled since the crisis began, as many lost their jobs or had their working hours reduced.

For mortgage brokers, it’s important to connect with customers and help steer them through this difficult period.

New data from the Australian National University (ANU) shows the share of Australians who were unable to pay their mortgage instalments or rent on time surged from 6.9% in April to 15.1% in May. Housing stress is much higher among renters than mortgagors.

Particularly worrying is the severe rate of housing stress among young adults. The ANU survey shows that nearly 50% of participants aged 18 to 24 were unable to pay their rent or mortgage instalment on time, compared to about 10% among those 75 years or older.

The study also found an almost threefold increase in housing stress among Australians aged 35 to 44 between April and May, with the proportion jumping from 5.9% to 19.1%.

“Clearly, the COVID-19 pandemic has put lots of young Australians under incredible stress. And this is while they are also likely dealing with other major stresses in their lives like potential loss of income,” says Professor Nicholas Biddle, co-author of the study.

Temporary relief

Fortunately for many Australians, government and bank policies to protect mortgagors and renters are tiding them over for now.

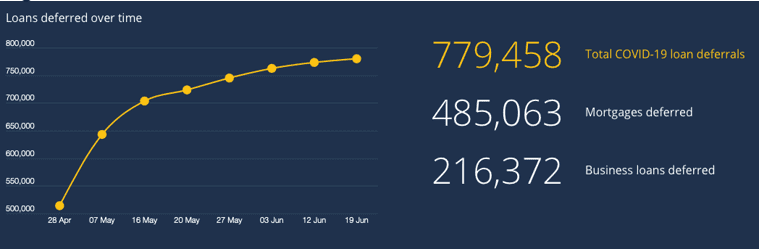

According to the ANU study, 16% of respondent mortgagors have managed to reduce their mortgage payments, and 8% have had their repayments paused. Data from the Australian Banking Association shows that more than 485,000 mortgages had been deferred as of 19 June.

Figure 1: Number of bank loans deferred as of 19 June 2020

Record-low interest rates are giving banks the flexibility not to require borrowers to resume repayments immediately.

“But they can’t extend these mortgage holidays forever, so there’s definitely going to be some people in a position where they will have to sell,” says Cameron Kusher, Director of Economic Research at property advertising company REA Group.

Mortgage arrears to rise

Before the government extended its JobKeeper scheme, nearly 100,000 mortgagors were predicted to default on their home loans as a result of housing stress.

The current economic environment has indeed increased the risk of home loan arrears, according to an ANZ report. As unemployment rises, many borrowers may struggle to keep up with their repayments given their high leverage and low savings rates.

“The unemployment rate has been relatively low in recent years, but we’re expecting it to rise in the next couple of years, and that’s going to increase the risk of arrears and housing stress for a lot of borrowers,” says ANZ economist Adelaide Timbrell.

The large number of Australians on a mortgage repayment freeze shows how vulnerable many feel about their ability to keep their homes, according to the Australian Housing and Urban Research Institute (AHURI).

Its previous research shows that between 2001 and 2010, Australian households sold their homes 1.9 million times and then moved into rental housing.

“If such findings from 2001 to 2010 hold true for the present economic situation, it is likely that a significant number of the households currently wanting to defer mortgage repayments will sell their home and move into rental housing either for a long period or permanently,” says AHURI.