Problems with finances, employee issues and long working hours are usually the biggest worries weighing on small business owners. Now, research shows that COVID-19 has become the number one cause of their stress and anxiety.

This is hardly surprising when we consider how small businesses have borne the brunt of coronavirus restrictions. But it also highlights the need for entrepreneurs to look after their mental health, particularly as the threat of the pandemic to business remains.

According to a survey by accounting platform MYOB, more than a third (36%) of participating business owners identified COVID-19 and its economic impact as the key business-related cause of their mental health challenges. Around a quarter (26%) answered financial concerns such as cash flow. Other factors affecting entrepreneurs’ wellbeing include attracting or retaining customers (9%), not having enough time for family (7%) and staffing issues (6%).

COVID-19 has particularly weighed on business owners in the retail and hospitality sectors, with 46% saying it has caused them mental health challenges.

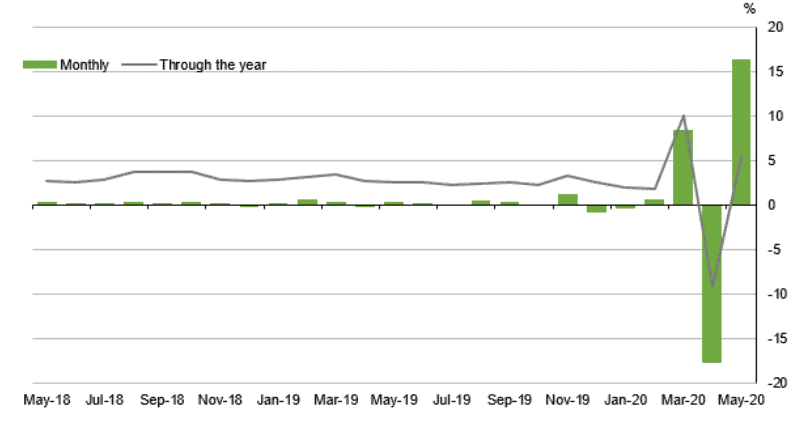

Retail and hospitality are two of the worst-hit sectors during the pandemic. A staggering 96% of hospitality businesses surveyed by the Australian Bureau of Statistics in late March expected adverse impacts in the months following the government’s rollout of social distancing restrictions. In retail, preliminary data shows that turnover fell by a record 18% in April before bouncing back in May.

Figure 1: Australia’s retail turnover in current prices

Source: Australian Bureau of Statistics

Triggering depression

Trading during the pandemic has taken a toll on some business owners: one in five said that running their business in 2020 has triggered depression. MYOB ran its survey at the height of the pandemic between April and May.

“Almost half of the small business owners and operators agree that running a business has had a direct impact on any feelings of stress and anxiety,” says MYOB Chief Employee Experience Officer Helen Lea.

In particular, it is younger entrepreneurs – those aged between 18 and 39 – who are most likely to say that they had felt anxiety or stress (68%).

Taking care of your wellbeing

Despite the impact on their mental health, many small business owners’ main concern right now is accessing government stimulus schemes that augment their incomes (29%). Mental wellbeing comes in second (26%).

“Many small business owners will be focused on staying afloat right now, but it’s important to balance that with looking after yourself,” says Small Business and Family Enterprise Ombudsman Kate Carnell.

Having this balance has never been more important as businesses face a lot of uncertainty and unprecedented challenges.

“The fact is, one in four Australians will experience depression or anxiety in their lifetime,” says Carnell. “Small business owners’ mental health may be intrinsically linked with the state of their small business.”

Seek help

If you’re feeling overwhelmed, call Beyond Blue on 1300 224 636. You can also read about how to manage your stress in these difficult times at beyondblue.org.au.

To learn how you can maintain your wellbeing while running your business, visit My Business Health. Smiling Mind also has resources to help you take steps to look after your mental health.