The foreign buyer boom is over, and we may not witness a repeat of the activity seen from 2012 to 2017, says a recent UBS report. This slowdown is expected to add to the woes of the property industry, which has already faced pressure from sluggish housing activity in major Australian cities and tighter lending conditions.

“For Australia, foreign buying activity peaked in 2016, moderating further into 2018, suggesting foreign buyers are unlikely to step up and provide an offset to lower domestic demand as credit conditions tighten,” says a UBS Evidence Lab report.

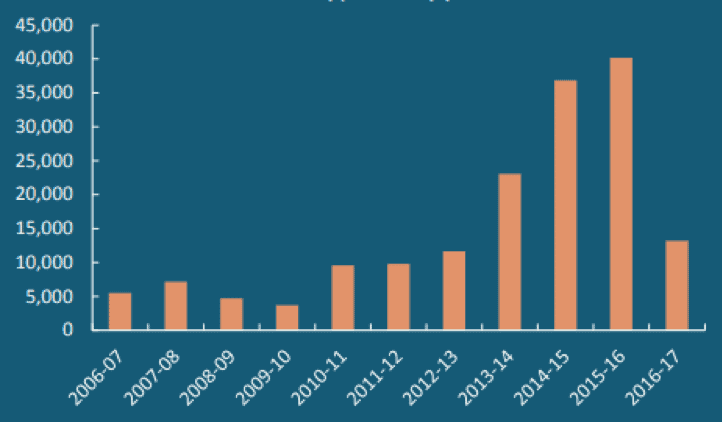

The latest data from the Foreign Investment Review Board (FIRB) backs this up. Residential real estate approvals – which foreign investors need to secure before they can buy property in Australia – plummeted from 40,149 in 2015–16 to 13,198 in 2016–17. The residential sector accounted for the largest drop in approved foreign investments by value, falling by more than 53% in 2016–17 to $25.2 billion.

Figure 1: Residential real estate approvals by year

Restrictions slow demand

The nosedive in foreign demand for Australian real estate, particularly from mainland Chinese buyers, is hardly surprising following a spate of government-led restrictions on foreign investors. These include less favourable tax treatment, additional or higher charges, and a cap on new development sales. Among new imposts, the Australian Government has imposed an annual vacancy charge on foreign buyers if a property is not occupied or available to rent for at least six months in a 12-month period.

Some states have also increased taxes on foreign investor purchases. The NSW Government has doubled the stamp duty for foreign property buyers to 8% and raised the annual land tax surcharge from 0.75% to 2%. The Victorian Government has also hiked the stamp duty surcharge on foreign purchases of residential property from 3% to 7%.

South Australia and Western Australia have this year become the latest states to impose a 7% surcharge on foreign buyers.

FIRB mainly attributes the 2016–17 drop in real estate approvals to the introduction in December 2015 of application fees for approvals of residential property sales. It also cited tighter Chinese capital controls and weaker market conditions as other potential factors.

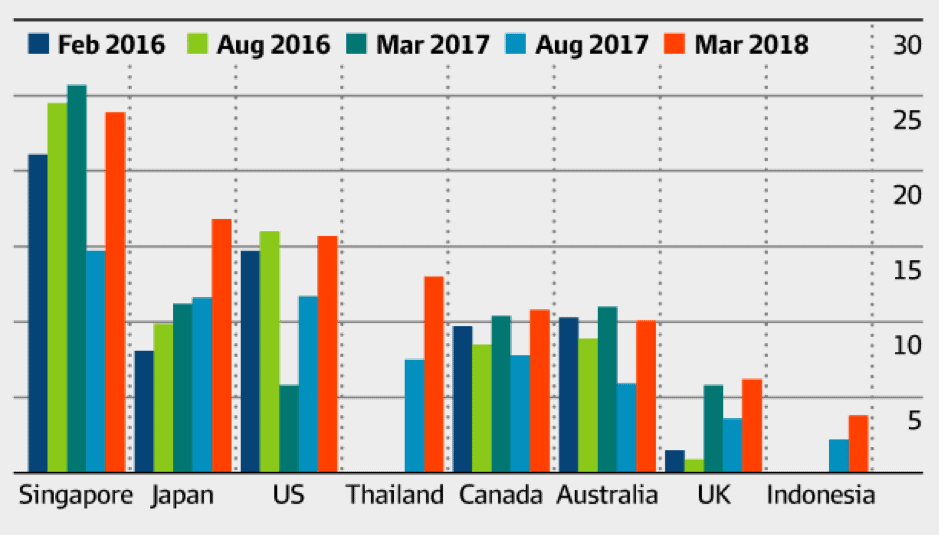

But UBS believes the higher charges were a bigger culprit. It says that mainland Chinese buyers – the largest group of foreign buyers of Australian property, according to FIRB – are deterred by stamp duty or upfront costs if they go beyond 5% of the property’s main purchase price.

Figure 2: Mainland Chinese investors’ sensitivity to foreign stamp duty rates (%)

Looking to other markets

Although offshore Chinese buyers have been more actively looking elsewhere for property since 2017, reports have shown that many foreign investors continued to favour Australia. Now it looks like this has changed.

UBS’s report shows that Australia is no longer one of the main Asia-Pacific destination countries for Chinese investors looking to buy residential property. “Our latest UBS Evidence Lab survey of 3,403 mainland Chinese shows growing interest in Japan and Southeast Asia, specifically Thailand, with our channel checks suggesting Vietnam is also on Chinese buyers’ radar,” says UBS.

Figure 3: Destination of Chinese overseas investment, excluding Hong Kong (%)

A headache for some developers

While the decline in foreign buyers affects the property market in general, it is causing a bigger headache for developers who have targeted mainland Chinese and other foreign buyers. CoreLogic Head of Research Tim Lawless has said that the 50% cap on foreign buyers in new property developments will significantly affect developers who sell much of their stock through roadshows in Asia and other regions.

However, despite the fall in offshore buyer activity, ANZ Senior Economist Daniel Gradwell believes foreign buyers will continue to have an important presence in Australia, attracted by the country’s strong economy and population growth.