For decades, overseas migrants and international students have propelled a property boom in major Australian cities. But as borders remain closed due to COVID-19, this may be coming to an end. The Australian Government expects net overseas migration in 2020–21 to fall 85% to just 36,000. It had earlier forecast 271,000 arrivals in 2020 and 267,000 in 2021.

Figure 1: Net overseas migration assumptions used in the 2019–20 Federal Budget

Note: The assumptions are on a calendar year basis.

Source: Australian Government, Federal financial relations: Budget Paper No. 3: 2019–20

Net overseas migration is the difference between the number of people moving to and leaving Australia. It has been the biggest driver of the country’s population growth, giving it a pivotal role in the economy. The Migration Council Australia predicted that by 2050, migration would contribute $1.6 trillion to Australian GDP.

But with population growth set to slump, the economy could face a shock. Deloitte Access Economics predicts the population will increase by just 0.8% in 2020 and 0.6% in 2021, down from a previous government forecast of 1.6% a year on average until 2027.

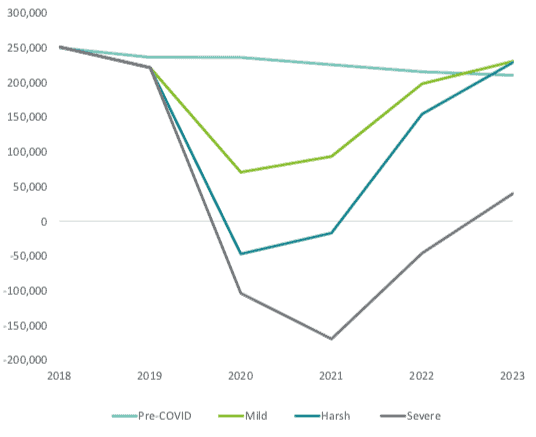

Figure 2: Forecast of Australia’s net overseas migration relative to pre-COVID expectations

Note: ‘Mild’, ‘Harsh’ and ‘Severe’ refer to the economic scenarios for COVID-19 recovery.

Source: Deloitte Access Economics, Economic scenarios for the COVID-19 recovery

“The economic implications could be significant,” says Liz Allen, a demographer and researcher at the Australian National University. “While border closure is important for health during COVID-19, the budget will take an enormous hit.”

The housing market will also take a tumble, say analysts. They expect demand from buyers and renters to fall, particularly in Sydney and Melbourne, which receive the largest number of migrants.

“Sydney and Melbourne arguably show a higher risk profile relative to other markets due to their large exposure to overseas migration as a source of housing demand, along with greater exposure to the downturn in foreign students,” says CoreLogic Head of Research Tim Lawless.

Pressure on property prices

Lower population growth will likely outweigh the impact of declining housing supply, putting downward pressure on home prices.

As CBRE Research notes in a report, Australia’s pool of new housing supply had been trending down before the COVID-19 pandemic. In 2019, housing completions dropped by 7%, and dwelling commencements, particularly of apartments in major capital cities, were also falling. Based on this, CBRE had forecast an undersupply of new dwellings this year, but it has updated its prediction.

“We are now certain there will be [a] downside to our previous forecasts of new supply, [although] the scale remains difficult to forecast at this juncture given the uncertainty of the speed of economic recovery in Australia,” says CBRE. “The impacts of a much lower rate of population growth from 2020–22 will, however, offset lower supply scenarios.”

Based on a population increase of 0.8% in 2020 and 0.6% in 2021, CBRE estimates that around 200,000 fewer dwellings will be needed over the next three years from 2020. NSW and Victoria will see the biggest loss in demand, with about 65,000 and 59,000 fewer dwellings required, respectively.

As population growth picks up to more than 1% in 2022, this will aid housing market recovery. But the process will be slow, according to property valuation firm m3property.

“Growth is not expected until mid to late 2022 and is forecast to accelerate in FY2023,” it says.