The Federal Government’s First Home Loan Deposit Scheme has kicked off, promising first‑time buyers a leg-up into the housing market. Instead of saving for years to raise a 20% deposit, Australians can buy their first property with a deposit as low as 5%.

Under the scheme, those earning less than $125,000 (or $200,000 for couples) a year can buy their first home earlier, with the Government acting as guarantor. The Government will also pay the lenders mortgage insurance (LMI), which banks typically require for deposits below 20%. This could save buyers around $10,000.

As good as the scheme may sound, mortgage brokers must brief their clients about this route to home ownership and help them make an informed decision.

Here are five key things first home buyers must know about the scheme.

1. It can help buyers become homeowners sooner

The program could slash the time it takes to save for a deposit. An average first-time buyer couple in Sydney, for example, could purchase a property almost five years earlier with a 5% than a 20% deposit, according to Domain analysis in May 2019. In Melbourne, couples could get into the market four years and three months earlier – and three years earlier in Brisbane, Canberra, Hobart and Adelaide.

With property values rising again, it might take longer now to save for a 5% deposit. Still, the scheme can considerably cut short the time it takes to home ownership.

2. It can be a more expensive route

Getting into the housing market sooner comes at a cost. By forking out a deposit of only 5%, buyers would need to take on more debt and as a result pay more in interest.

For example, buyers taking out a loan on a 4.61% mortgage rate and with a 5% deposit without LMI would have to pay $845,808 for an entry level house worth $512,000, according to Domain. That is $53,000 more than they would pay with a 20% deposit.

But as interest rates fall further – they’ve reached a low 2.77% for variable owner-occupier loans – the total cost for buyers could be reduced.

3. It is available to a limited number of buyers

The deposit scheme offers only 10,000 guarantees a year on a first-in, first-served basis – a small figure compared to the number of Australians aspiring to own a home.

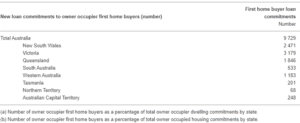

In November 2019 alone, there were 9,729 first homebuyer loan commitments across Australia. So, with more than 100,000 commitments a year, fewer than one in 10 first homebuyers could get their foot in the door through the scheme.

Figure 1: New loan commitments to first homebuyers, November 2019

Source: Australian Bureau of Statistics

But expanding the scheme would be counterproductive, according to the Grattan Institute. “It would push up prices, benefitting sellers at the expense of first homebuyers, while increasing the risks of inappropriate lending at costs to both households and government.”

4. Property prices are capped

To control demand and prioritise those who really need help, the Government has capped the values of property applicants can buy. By doing this, it hopes buyers would acquire modest dwellings in regional towns and capital cities.

This means the program might not work for many potential buyers in major capital cities, where affordability is a serious problem. Prices in Sydney and Melbourne, for example, are capped at $700,000 and $600,000 respectively, but the median home values are $973,664 and $778,649 as of December 2019.

Figure 2: Deposit scheme’s property price thresholds

Source: National Housing Finance and Investment Corporation

5. It doesn’t make housing more affordable

Finally, the scheme doesn’t address the problem of affordability. In fact, it could make it even more difficult for lower-income earners to own a home because of the high income ceiling, according to Eliza Owen, CoreLogic’s Head of Australian Research.

Owen believes the scheme may advantage those near or at the top of the threshold at the expense of lower-income buyers because higher earners can save for a deposit more quickly.

“Introducing a high income threshold for a program with limited numbers, could make it more regressive,” she says.