Many small business owners are worrying about their company around the clock as accessing finance through banks becomes more challenging.

According to a recent survey by research firm YouGov, more than half (54%) of small business owners spend six to seven days a week working on their business. While this is hardly surprising, the survey also found that for eight in 10 (78%) respondents, at least some of their business concerns involve cash flow.

Interestingly, the research shows that the more entrepreneurs fret over cash flow, the more likely they are to worry about their business constantly.

These findings coincide with mounting evidence that an increasing number of small businesses are struggling to get funding to boost their cash flow.

Figure 1: Ease of small and medium-sized enterprises’ access to finance

In a September 2018 survey by marketing company Sensis, more than 30% of participating small and medium-sized enterprises said it was difficult to access funding – up from 20% a year ago.

Only 14% said obtaining finance was relatively easy, down from 34% the previous year.

Overall, the net balance for accessing finance dropped 14 points to -17, the lowest level recorded since June 2013. Manufacturing and retail businesses struggled the most.

Tougher to secure financing

Small businesses have typically found it tough to get loans from banks without security – which is usually property. Startups have a particularly hard time because banks consider them high risk.

When smaller and riskier companies do get loan approvals, they often face high interest rates, according to a recent report by the Reserve Bank of Australia (RBA).

The fallout from the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry seems to have made it even harder for small businesses. Jittery banks have tightened their lending criteria – including for self-employed loan applicants – since the inquiry began. They have also toughened their serviceability requirements following the Australian Prudential Regulation Authority’s (APRA’s) rules.

The RBA report confirms the increased scrutiny of financial institutions’ conduct has indeed extended to small business lending. Banks find it easier to apply the responsible lending rules for consumers to enterprises because of the blurred line between entrepreneurs’ business and personal finances, according to the report. Many business owners use the same bank for both business and personal matters.

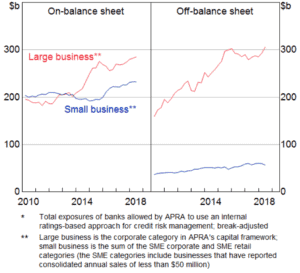

Figure 2: Business lending by Australian banks

Despite the difficulty of obtaining funding, lending by banks to small businesses has grown in recent years. But, as Figure 2 shows, it has expanded more slowly than lending to large businesses.

Potential solutions

Two federal government initiatives could open new avenues for small enterprise financing: the Australian Business Securitisation Fund and the Australian Business Growth Fund.

Under a recently announced finance policy, the government will set up a $2 billion securitisation fund to enable smaller banks and non-bank lenders to lend to small enterprises on more competitive terms.

The growth fund will provide longer-term equity financing and is expected to attract $500 million in initial investment. To create the fund, the government needs the backing of APRA and banks, which will serve as investors. APRA has already indicated that it may lower the risk weighting for banks’ contributions to the fund. This means the fund should be able to offer small businesses equity financing as early as mid-2019.