Australia’s housing value slump has eased, according to CoreLogic’s latest Home Value Index. The index reveals that the rate of decline has been decreasing since September 2022, with February’s 0.14% decrease being the smallest monthly fall since the Reserve Bank of Australia (RBA) began increasing interest rates in May 2022.

A 0.3% increase in Sydney housing values was the most substantial driver of the trend. However, every capital city except Hobart saw housing values fall by less than half a per cent over the month. Hobart housing values fell by 1.4%.

This positive trend has continued through the first half of March, according to CoreLogic’s research director, Tim Lawless, who noted that the Daily Home Value Index was up 0.3% across the five largest capitals over the first 15 days of the month.

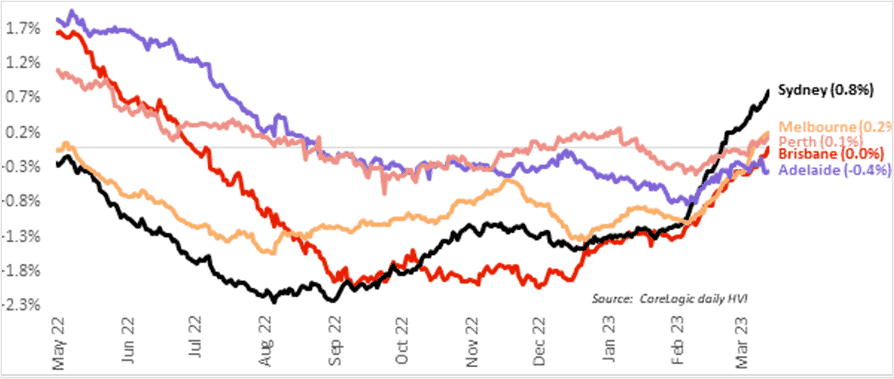

On a rolling four-week basis, Sydney has seen a 0.8% lift in values, Melbourne is recording a 0.2% lift and Perth has seen values rise by 0.1% (see Figure 1). Meanwhile, Brisbane remains unchanged over the past four weeks, while values in Adelaide fell 0.4%.

Figure 1. Rolling four-week change in dwelling values since the first rate hike

Source: ‘Positive trend for housing values through first half of March but bottom of the cycle could still be ahead’, CoreLogic

Fewer listings maintain a floor under house prices

Lawless said the return to a more positive trend in housing values coincides with a consistently lower-than-normal flow of new listings coming on to the market.

“Capital city listings over the past four weeks were 19.9% below the previous five-year average for this time of the year,” he said. “Such low advertised supply is likely to be a central factor keeping a floor under housing prices despite a clear drop in demand.

“At the same time, we have also seen a rise in auction clearance rates back to around the decade average.”

PropTrack’s February Listings Report notes that while property market activity has picked up significantly, it remains quieter than in the same period in 2022.

“New listings in capital cities picked up in February ahead of the autumn selling season, rising 26.6% month-on-month,” wrote PropTrack economist Angus Moore. “Even so, new listings were down compared to a year ago, with 13.2% fewer new listings compared to the busy start to 2022. Regionally, new listings were also lower than last year, down 7.6%.”

Moore predicts that market activity will continue to pick up during autumn, but “by how much remains to be seen”.

Despite the positive signs, Lawless cautions that the bottom of the cycle may still be ahead. He points to the possibility of further rate increases and weakening economic conditions through mid-2023 as household savings buffers are exhausted and the full impact of the RBA’s interest rate hikes are felt by homeowners.

“One of the key metrics to watch will be the flow of new listings coming on to the market,” he said. “A rise in advertised supply to above average levels could be a signal this recent trend of growth has run out of steam.”

National housing values remain ahead of pre-pandemic levels

Despite recent housing market volatility, national housing values continue to be significantly higher than they were at the beginning of the COVID-19 pandemic.

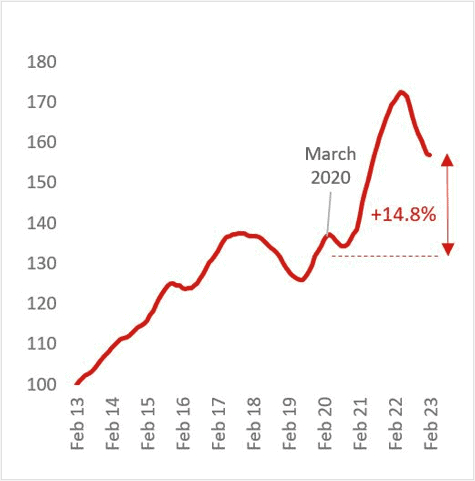

According to CoreLogic figures, national housing values are 14.8% higher than they were in March 2020 (see Figure 2). This is down 9.1% from the market’s peak in April 2022, when housing values were 28.6% higher than pre-pandemic levels.

Figure 2. National home value index

Source: ‘Three years on from the pandemic: is the housing market going ‘back to normal’?’, CoreLogic

The figures also show that homeowners in some states have done substantially better than those in other states. Adelaide has come out well ahead of other capital cities, with house values now 43.7% higher than at the end of March 2020 – the equivalent of a $211,097 increase in the city’s median house value. This compares to the equivalent median house value gain in Sydney ($119,830). Meanwhile, Melbourne median house values have declined since March 2020, by the equivalent of $1,009.

Regional values also remain higher than they were pre-pandemic, with values across the combined regional dwelling market remaining 30.7% higher than in March 2020.

Uncertainty about future rate rises continues

The immediate future of housing values is likely to depend on the RBA’s upcoming decision on further interest rate increases.

The RBA board indicated in March that it will consider a pause on further interest rate rises at its April meeting as it assesses whether it has done enough to rein in inflation. However, increased financial market volatility caused by the recent collapse of several US banks and the forced sale of Credit Suisse to UBS in Europe have heightened uncertainty about what the RBA will do.