Australia’s property market ended 2021 by smashing records, with median house values across all capital cities surpassing $1 million for the first time. But has the market peaked?

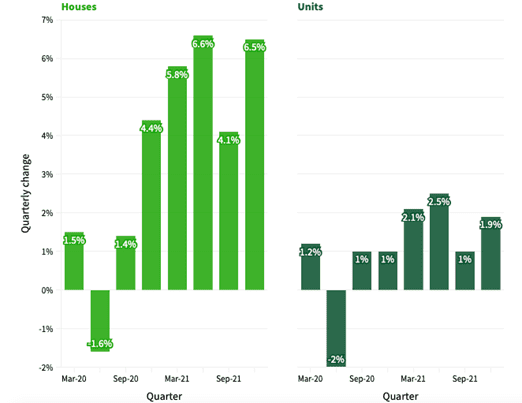

New data from Domain shows that median house prices rose 6.5% to $1.07 million and unit values grew 1.9% to $621,880 in the last quarter of 2021, continuing a trend that’s driven up homeowner equity and lifted many business owners’ borrowing capacity.

Figure 1. Quarterly change in Australia’s median house and unit prices

Source: Domain’s December 2021 House Price Report

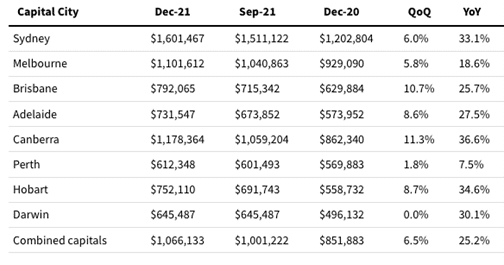

Figure 2. Stratified median house prices

Source: Domain’s December 2021 House Price Report

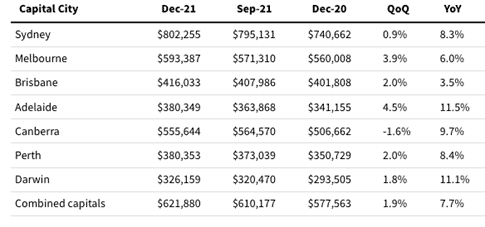

Figure 3. Stratified median unit prices

Source: Domain’s December 2021 House Price Report

According to Domain’s Chief of Research and Economics, Dr Nicola Powell, demand continues to eclipse supply in most of Australia’s capital cities.

“House and unit prices continue to beat records nationally due to lockdown activity rebounds in Sydney, Melbourne and Canberra, high household savings and the ongoing demand from Australians to buy a property,” says Powell.

“Since the pandemic began, house prices have risen 52%, the highest rate of growth recorded across the capital cities.”

Record growth in capital cities

House prices in Sydney had particularly spectacular growth. They rose by roughly $1,100 a day over 2021, or 33.1% annually, to reach $1.6 million in median value – the city’s steepest annual growth rate on record.

Sydney’s unit prices also hit a new record high of $802,255 in 2021, growing 8.3% annually.

In Melbourne, median house values reached $1.1 million and unit prices $593,387, growing by 5.8% and 3.9% respectively over the last quarter of 2021, as buyer and seller activity rebounded after months of lockdowns.

As house prices hit a new high of $1.2 million, Canberra has become Australia’s second most expensive city for buying a house. Growth in unit prices fell 1.6% to $555,644 over the quarter, though.

Losing momentum

While it’s hard to know for sure if the housing market has reached its peak, the combined house and unit price growth in the December 2021 quarter lost momentum compared to earlier in the year, according to Domain. This suggests that the peak rate of growth has passed. And this year, the breakneck increase in prices, and housing affordability problems, are likely to weigh on demand.

“The rapid escalation in house prices will be a financial barrier for entry buyers and upgraders against a backdrop of low wages growth,” says Powell.

“The disparity between property performance and associated affordability constraints is expected to drive demand to units. While it is still a competitive market for home hunters, rising supply and easing demand trends should support more realistic seller prices and greater buyer choice.”

Impact on demand

Westpac Senior Economist Matthew Hassan agrees.

“Key factors at play here are around the challenges of affordability – which will weigh on housing demand over the year ahead – and the shifting situation in policy settings, particularly from the Reserve Bank of Australia,” he says in a report.

Hassan points out that the growing expectation is that increases in the official cash rate will be brought forward this year. Ultra-low interest rates have been one of the major drivers of the rising property prices in recent years. Now, with the cash rate possibly going up earlier than 2023 as previously expected, this casts a pall over demand for housing.

“The Westpac economics team now expect[s] one rate hike of 15 basis points in August this year, followed by a further hike of 25 basis points in October, and further increases carrying through most of 2023 and 2024,” says Hassan.

“And our most recent Westpac–Melbourne Institute consumer sentiment survey showed 55% of consumers, too, think rates will rise this year. This is the highest proportion expecting interest rate rises since February 2018.”

Taking all this into account, Hassan expects “a very different period ahead for the housing market”.

“The days of half a trillion a quarter value gains in the dwelling stock look to be behind us now,” he says.