The impact of the pandemic continues to shape Australia’s property market, four years on. Dwelling prices have exploded as factors such as population growth and limited supply drive competition for homes.

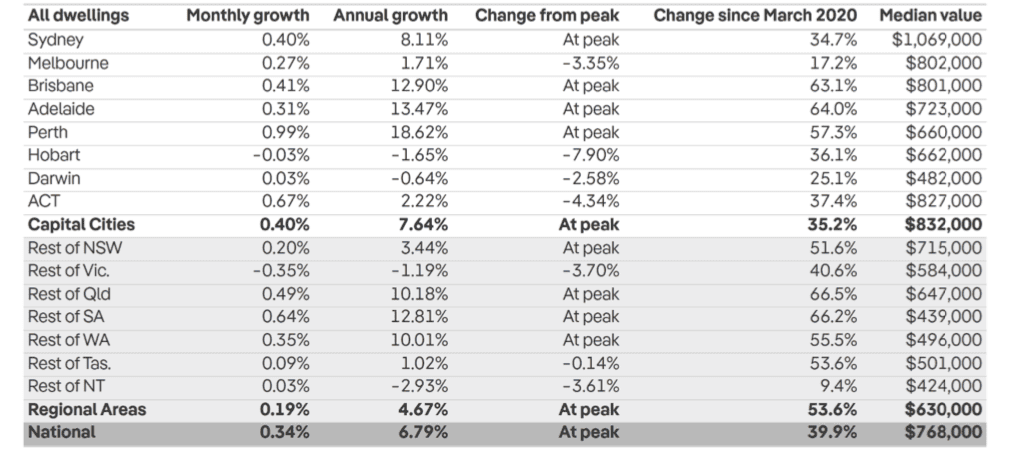

According to data from PropTrack, national home values surged by 39.9% from March 2020 to March this year. Prices in regional areas soared by nearly 54%, notably outpacing those in capital cities across all states, except Western Australia and the Northern Territory.

“Throughout this four-year period, multiple factors have influenced and shifted housing trends, with the housing market cycling through different phases,” says PropTrack Senior Economist Eleanor Creagh.

Figure 1: Home price growth, March 2024

Source: PropTrack Home Price Index, March 2024

Increased population drives price growth

As the PropTrack report highlighted, coastal and regional areas have experienced strong population growth and increased housing demand from internal migration. This has often been at the expense of Sydney and Melbourne.

“In fact, regional areas experienced the biggest net influx since Australian Bureau of Statistics records began in 2001,” notes Creagh.

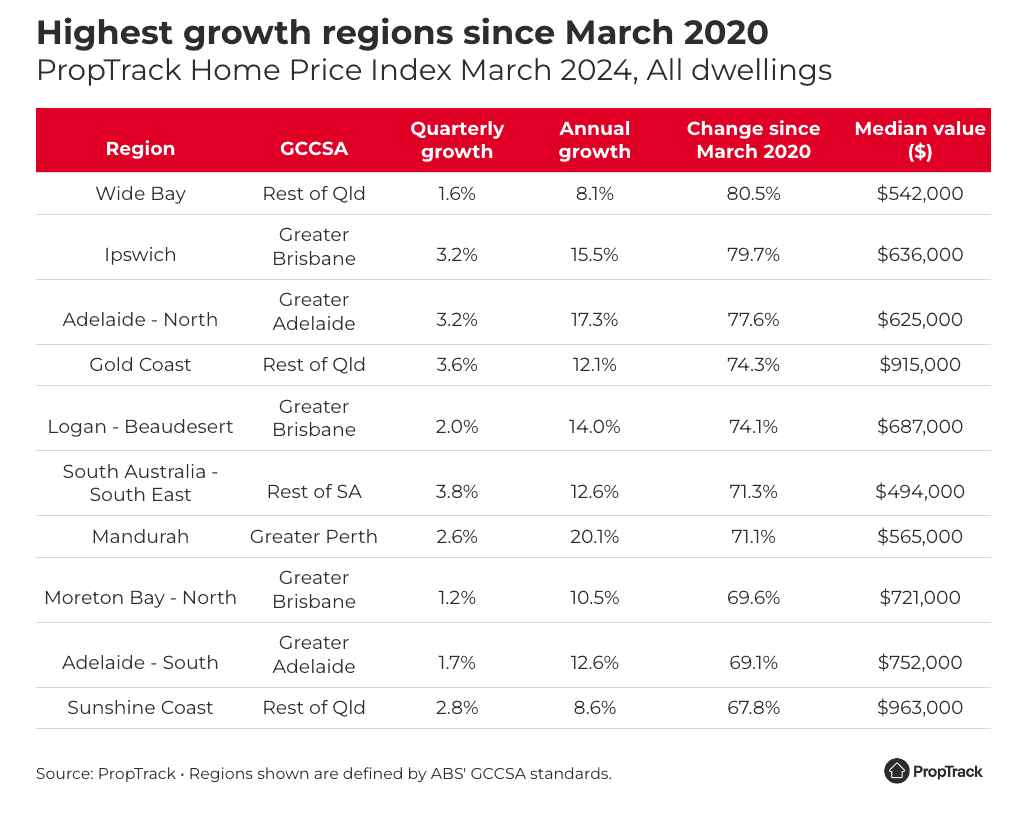

Queensland – both in its metro and regional areas – has particularly witnessed unprecedented population flows, attracting more people from other states and territories than any other place in the country. The state boasts six of the top 10 regions with the highest growth in housing prices.

“Affordability has played a part in these trends, and cheaper regions have generally seen stronger growth over the past four years,” adds Creagh.

Figure 2: Regions with highest home price growth, March 2020 to March 2024

Source: PropTrack Home Price Index, March 2024

Overseas migration has also buoyed demand for housing over the past two years in both capital cities and regional areas. Data from the Australian Bureau of Statistics (ABS) shows that international migration resulted in a net gain of 518,000 people to Australia’s population in the year ending 30 June 2023. This marked the largest net overseas migration since records began.

“Many potential migrants didn’t come to Australia in 2020 and 2021 because of border closures and other pandemic impacts,” says Jenny Dobak, ABS Head of Migration Statistics. “In 2022–23, the number of migrants arriving on temporary visas has gone up [while] the number departing has reduced slightly.”

Impact of interest rates

Monetary policy is another factor driving housing demand. As fixed mortgage rates dropped below 2% in mid-2022, many borrowers seized this opportunity to take out property loans.

“So far, borrowers have navigated higher mortgage rates much better than expected with mortgage arrears holding below pre-pandemic levels,” says Tim Lawless, Executive Research Director of Corelogic’s Asia Pacific research division.

Demand and supply dynamics

Finally, tight rental markets have contributed to soaring home prices by increasing demand for homeownership and intensifying competition. Recent data shows that the national vacancy rate reached a new record of 0.7% in February.

“Nationally, rents have jumped 32.4% since March 2020, adding approximately $150 a week to the median dwelling rent,” says Lawless.

Despite significant demand, the housing supply has not increased sufficiently. As Creagh points out, higher financing costs, rising material expenses, labour shortages and increased insolvencies in the building industry have collectively reduced the number of new projects and slowed the completion of ongoing ones.

“It’s clear the supply side of the housing market needs to be able to better adjust to shifts in housing demand,” she says.