Housing prices in Australia have fallen to their lowest levels in six years, according to the latest RP Data survey released for the month of May. According to the report, home values are currently 1.4 percent lower than what was seen in the April survey and this equates to a 5 percent drop relative to the home price values that were seen in May of 2011.

But perhaps what is most surprising is that these price declines are coming at a time when the Reserve Bank of Australia (RBA) is acting to make monetary policy less restrictive. The latest RBA activity to accomplish this (by lowering its base interest rate to 3.5 percent) aims to act as a counter-measure for the economic slowdown that is being propelled by the debt crisis in Europe and the manufacturing declines seen in China.

Melbourne Leads Price Declines

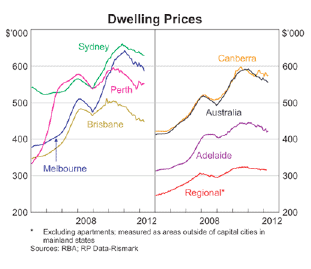

Looking at the specifics of the RP Data report, most of the declines can be seen in detached housing prices, rather than in apartment sales. Some cities fared better than others, with most of the declines seen in Melbourne, where residential property values now seen 2.7 percent than the previous month and down more than 8 percent relative to the same survey period last year. Similar numbers were posted in Sydney (which, for the most part, has remained relatively strong during this downtrend in real estate markets). Home values in Sydney dropped 1.2 percent from the levels seen in April, creating a 3.6 percent decline on a yearly basis.

On the positive side, the housing market in Adelaide helped to balance out these negatives and actually showed an increase on 1.2 percent for the month of May. Other encouraging news came out of Brisbane, which is starting to show evidence of reversing its two year downtrend with home prices mostly unchanged relative to April, showing a small drop of 0.3 percent. In recent quarters, the river city of Brisbane has seen some of the largest declines when compared to all other capital cities in Australia, so this slowdown in negative growth is one of the small bright points of the RP Data survey. Overall, however, the tone of the report was dismal, with Perth, Darwin, Canberra and Hobart all posting declines of at least 1.5 percent. Darwin and Perth were the most disappointing of the group, showing drops in value of 2.4 and 1.7 percent, respectively.

Rate Cuts Prove Ineffective, So Far

The puzzling factor for many analysts is the fact that recent rate cuts from the RBA have thus far failed to filter into the real estate markets by stimulating demand. The RBA has moved three times in recent quarters to stimulate the economy (also reducing interest rates last month and in November of 2011) but these decreases have had little effect on the economic data releases that have been made available since then.

But with housing prices likely to remain weak only as long as consumer confidence remains weak, many analysts have started to suggest that a bottom is near as the broader Australian economy constructs a bias that is supportive of increasing demand. With housing affordability continuing to improve and lower interest rates making mortgage lending easier to conduct, the only missing ingredient is growth in disposable income for Australian households, and the latest figures in this area have started to reverse higher.

Using the peak in home values that was seen in November 2010 as a reference point, disposable income in individual households has risen by over 5 percent. Without any substantial shocks, this trend could easily be the deciding factor in whether or not the downtrend in home values has reached completion. Key areas to watch can, of course, be seen in consumer sentiment surveys but also in the number of properties that are currently listed for sale. Recent estimates from RP Data show that there were roughly 308,500 residential properties throughout Australia in May, and this is nearly 10 percent higher than the number of properties listed at any time in 2011. Reductions in this area could be one of the early indications that the downtrend in home values had reached its bottom.