A year ago, Australian housing prices were mostly in freefall. Economists predicted them to dive by as much as 25% in Sydney and Melbourne, and 15% nationally from peak to trough. But things changed by mid-2019. National home values bottomed out in June – having fallen 8.4% since their 2017 peak – and have been climbing since then. And they are now forecast to increase by up to 11% in 2020.

This is good news for homeowners and investors, but they must beware of frailties of the property market’s recovery.

Soaring prices

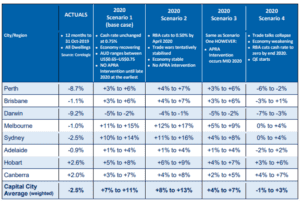

According to SQM Research, housing prices could rise as much as 15% in Melbourne and 14% in Sydney in 2020, driven by low interest rates and a potential easing of credit curbs. Nationally, home values could grow by up to 11%, assuming the cash rate remains at 0.75% and the Australian Prudential Regulation Authority does not restrict lending to rein in soaring home prices.

Figure 1: SQM Research home values forecast for 2020

Source: SQM Research, Christopher’s Housing Boom and Bust Report 2020

CoreLogic and Moody’s also expect home prices to increase in 2020 but are more conservative in their forecast. They have predicted gains of 5.4% nationally, 7.7% in Sydney and 7% in Melbourne.

“We’re seeing a sustained pick-up in the Sydney and Melbourne markets from the third quarter [of 2019], and we’re expecting that to continue right through 2020,” said Moody’s Analytics economist Katrina Ell.

Ell acknowledged that the low interest rates could drive higher-than-forecast home price increases in Sydney and Melbourne. “[That] would likely lead to further household leveraging,” she said.

Figure 2: CoreLogic and Moody’s home values forecast for 2020

(year-on-year % change)

Sources: CoreLogic and Moody’s Analytics

Elsewhere, CoreLogic and Moody’s expect home values in Perth to continue declining in 2020, after falling by almost 8% in 2019.

“We’re already seeing that the pace of decline in Greater Perth houses has slowed,” Ell said. “By 2021, we will start to see a return to value growth in this market,”

In Brisbane, CoreLogic and Moody’s predict home prices will likely grow slower than in other major markets, at around 2% in 2020.

SQM Research expects higher price gains of 3% to 6% for Perth and Brisbane, as mining investment recovers in both cities.

Misgivings

Christopher expressed doubts about the sustainability of the housing market recovery, particularly in Sydney and Melbourne, because prices are rising from an already overvalued starting point.

“Long term, our two largest housing markets look vulnerable and forever reliant on cheap credit,” he said. “Housing debt, while falling compared to GDP [gross domestic product] over 2019, is still very high.”

In Sydney, home values are still about 60% higher than their 2012 level and will not likely reach their gains of recent years, according to Ell. “Housing values have risen at a faster rate than what fundamentals – income, population and interest rates – suggest.”

Shane Oliver, AMP Capital’s Chief Economist, also expects house price gains to be constrained.

“Compared to past cycles, debt-to-income ratios are much higher, bank lending standards are tighter, the supply of units has surged with more to come,” said Oliver. “This has already pushed Sydney’s rental vacancy rate above normal levels, and unemployment is likely to drift up as economic growth remains soft.”

Beyond Sydney and Melbourne

In terms of buying opportunity, experts believe housing investors can find greater value outside Sydney and Melbourne.

“There is probably better value to be found in regional centres and Perth,” said Oliver. “Brisbane looks attractive in offering reasonable yields, a low vacancy rate and improving population growth.”

Hobart is also attractive, according to Simon Pressley, Managing Director of property research firm Propertyology.

“The latest ABS [Australian Bureau of Statistics] economic data now has the Tasmanian economy as officially Australia’s fastest growing, while housing supply is literally at crisis levels,” said Pressley. “Propertyology expects Hobart to produce strong growth in property prices and rents for some time yet.”