When the pandemic took hold in March, stock prices across the globe took a dramatic hit. But as governments swung into action to contain the virus and its impacts, the stock market soon stabilised. Now, as we continue to come to grips with living in a COVID-19 world, a Credit Suisse report indicates that global wealth, as a whole, is also bouncing back.

On New Year’s Day 2020, the future of global wealth was bright. The year before, total global wealth had increased by a staggering 36.3 trillion, an 8.5% gain on 2018. With GDPs across the world continuing to grow, economists predicted this astronomical growth would continue well into the third decade of the 21st century. But by March 2020, COVID-19 had wiped US$17.5 trillion from the global coffers – or 4.4% of wealth across the world.

Now, edging towards the end of an extraordinary year, many economies have reopened and we’re becoming more used to managing the virus. Credit Suisse’s Global wealth report 2020 predicts that, by the measure of household wealth, December 2020 will look much like December 2019 across the world.

“It seems highly likely that global household wealth … has held up extremely well in the face of the economic turmoil confronting the world,” according to the report’s authors. But is that as true in Australia as it is overseas?

The recovery is uneven

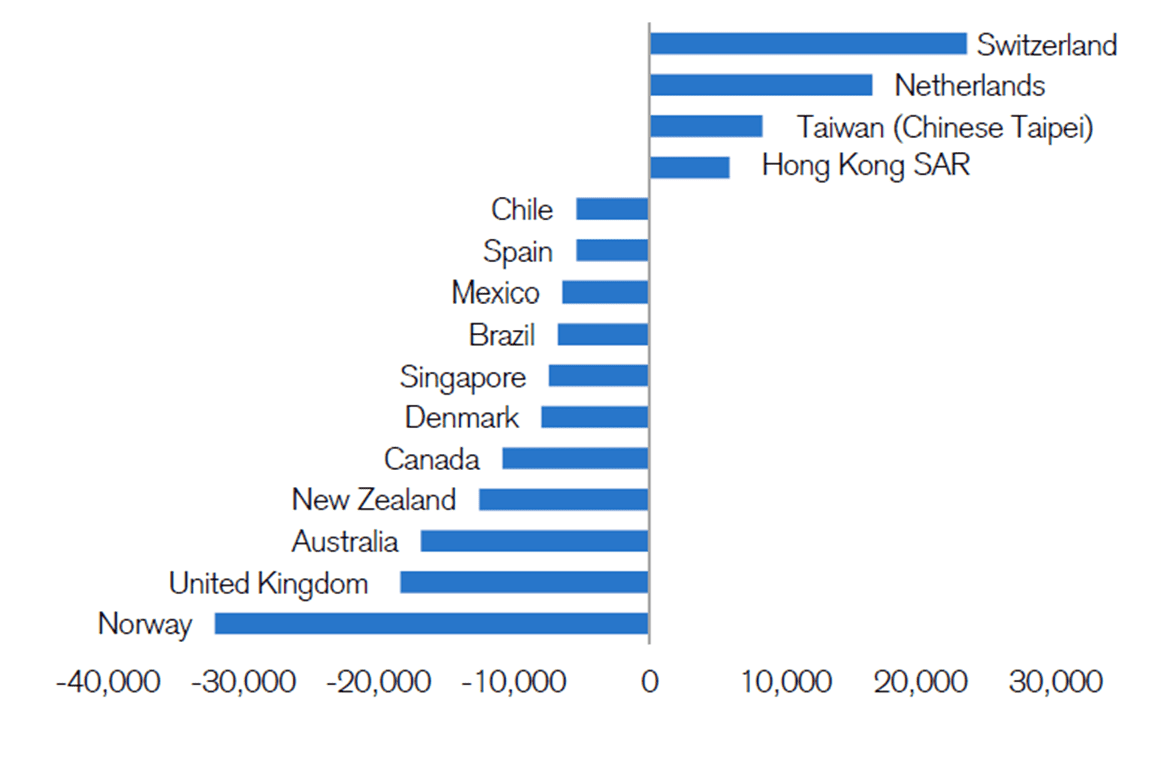

Australia was one country, along with the United States (US), Canada and Denmark, where net household wealth fell more than 9% between January and June 2020. In six short months, the report estimates that wealth per Australian adult dropped between 4% and 5%.

Figure 1: Change in wealth per adult (USD) from January to June 2020

Across the rest of the world, net household wealth dropped by an average of 4.4% in the initial months of the pandemic. Although it’s now rebounding, this is largely due to increases in household wealth in other countries. India’s household wealth, for example, has grown 1.6% this year, surpassed only by China with 4.4% growth.

Unfortunately, Australia’s record-low interest rates haven’t been enough to buffer us from factors like the depreciating exchange rate.

Who’s paying the price?

According to the report, the financial turbulence of 2020 hasn’t discriminated on the basis of wealth.

“The worldwide impact on wealth distribution between countries has been remarkably small given the substantial pandemic-related GDP losses,” says Urs Rohner, Chairman of the Board of Directors at Credit Suisse.

In fact, the report suggests that wealth inequality seems to have declined in countries such as the US. Yet Credit Suisse acknowledges this conclusion is likely the result of inadequate data, citing OECD figures on unemployment rates. These figures show that, in the second quarter of 2020, the number of jobs for men contracted by 7%, while jobs for women contracted by 9.5%. The stats are similarly dire for other historically disadvantaged groups, including young people and minorities.

Today, measures such as Job Seeker make it difficult to ascertain the true cost of COVID-19 to Australia, and the way that wealth is distributed within it. But according to the Credit Suisse report, the pandemic’s disproportionate impact on these groups will affect their ability to accumulate wealth for years to come.

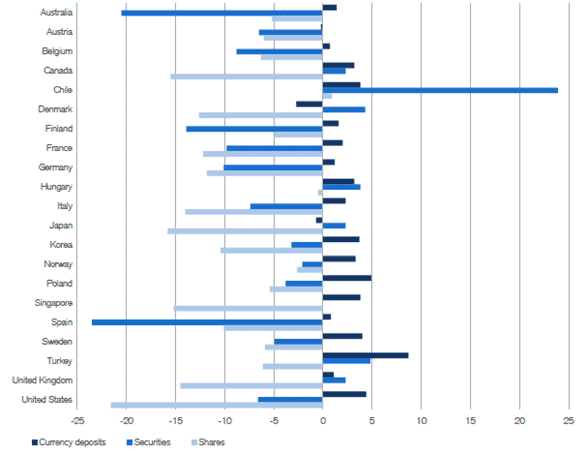

Figure 2: Change in components of financial assets from January to March 2020

What’s next?

In the short term, China is the only player among the world’s major economies predicted to see material wealth gains. Wealth levels in the US, on the other hand, have fallen by about 5% per adult, and aren’t expected to recover before the end of 2021.

For other countries including Australia, reduced economic growth and changes in corporate and consumer behaviour will put a dampener on the accumulation of household wealth well into the medium-term future.

Yet considering that, in 2019, Australia ranked first in the world for median wealth and fourth in the world for average wealth per adult, we’re in a stronger position than many. In terms of forecasted GDP, Credit Suisse places Australia 10th in the world, a ranking the firm’s local Chief Investment Officer, Andrew McAuley, calls “a solid result”.

While the challenge of our post-pandemic recovery is by no means over, Australians have plenty of reasons to feel optimistic.