After fears of mass defaults at the height of the COVID-19 pandemic, the worst seems to be over for many Australian borrowers. Data shows the number of loan deferrals has fallen sharply as economic recovery gathers pace. But for those who haven’t resumed repayments, the crunch time is looming.

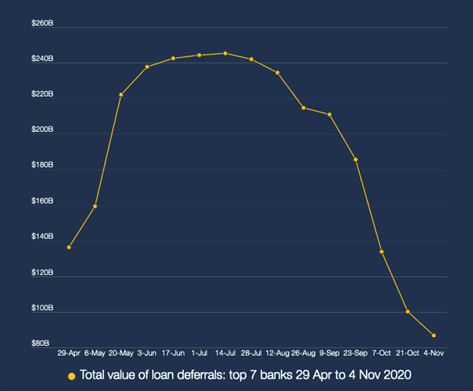

A new report from the Australian Banking Association (ABA) shows that the total number of deferred loans has dropped from 900,000 at the peak of the crisis around June to below 300,000 recently. Among the seven largest banks, the value of deferred loans collectively fell from more than $250 billion in June to $86 billion in early November.

Figure 1: Total value of loan deferrals at Australia’s top seven banks

Banks allowed struggling borrowers to pause their loan repayments for six months from March. The loan holiday scheme has since been extended by four more months to the end of January 2021.

Australia’s top seven banks saw the number of borrowers taking advantage of mortgage loan deferrals fall 66% to fewer than 170,000. Similarly, the number of business loans on pause declined 68% to 72,900 – out of which more than 65,000 are loans to small and medium-sized enterprises (SMEs).

“This is an encouraging sign that most Australians are through the worst,” said ABA Chief Executive Officer Anna Bligh.

Tough choices

While the falling number of deferrals is definitely welcome news, many borrowers are still struggling to pay back their loans. They face difficult choices as government stimulus and bank support programs wind down next year.

“I don’t think anybody’s trying to look at this through rose-coloured glasses,” said Bligh. “Banks have said very publicly and very honestly that, for some of their customers, 2021 is going to mean facing some pretty tough decisions.”

According to Morningstar equity analyst Nathan Zaia, many small businesses might not survive after the government’s JobKeeper Payment scheme ends in March 2021.

“There are businesses now that are getting subsidies to pay their own staff and they’re also benefitting from sales from consumers who have the support payments,” said Zaia. “So, they’re going to get hit on both fronts. Ultimately, there will be a lot of businesses that can’t continue.”

Many small businesses have relied on JobKeeper since the government rolled out social distancing and other measures to curb the spread of COVID-19 last March. Research by management solutions firm MYOB in June found that 84% of participating SME owners who were eligible for JobKeeper depended on it to continue trading.

Surprisingly resilient

Mortgagors have been more resilient than observers had thought. Fitch Ratings, for example, expected Australia’s 30+ days mortgage arrears to rise in the third quarter of 2020, but this didn’t happen. The agency now expects arrears to rise in the second quarter of 2021 after stimulus programs end.

ANZ also predicts a slight increase in arrears in the next 12 months but believes the expiring majority of mortgage deferrals and support from banks will likely offset this.

For borrowers still in financial hardship, Bligh said it’s important not to wait until you are in dire straits before getting help. “Talk to your bank,” she said. “They’ll help you find a way through this. Don’t tough it out on your own.”