We all know young Australians’ struggle to get a foot in the housing market. But is their spending on avocado toast and expensive coffee really to blame, as some have suggested?

Apparently not. In fact, research by the Actuaries Institute shows younger people are spending less today on non-essential items, such as alcohol and clothing, and more on necessities, such as housing, than they did 30 years ago. And they have faced more economic and housing disadvantages compared to older generations.

Mind the Gap – The Australian Actuaries Intergenerational Equity Index shows the wealth of Australians aged 25–34 is at its lowest in nearly 20 years. The study attributes this to falling rates of home ownership and increased government spending on older Australians.

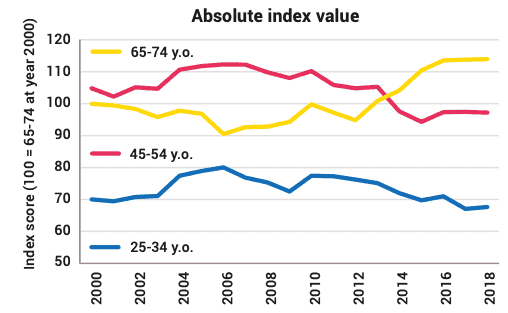

Figure 1: The Australian Actuaries Intergenerational Equity Index, 2000–2018

“The wealth effects of the housing boom, plus rapid increases in government payments on pensions and services for older people are key reasons that young Australians today have relatively lower wealth and wellbeing index scores than that of their parents at a similar age,” says the report.

Lower government spending and home ownership

According to the study, government spending on Australians aged 65 to 74 rose from 3.7% of GDP to 4.5% over the past decade. But it was flat for those aged 25 to 34 and 45 to 54.

However, the biggest disadvantage younger Australians face is in housing. While home ownership levels are naturally higher for older Australians, younger generations have struggled more to get in the market as home prices have risen faster than incomes, notes the Actuaries Institute report.

Adding to this predicament are low interest rates. They have made saving for a deposit more difficult and boosted demand for housing, driving property prices even higher.

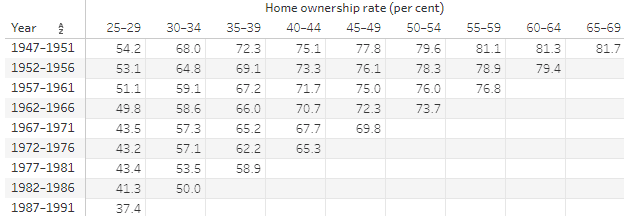

As a result, the home ownership rate of those aged 25 to 34 dropped from 51% in 2001 to 37% in 2018. But it remained stable for older cohorts, according to the report.

Indeed, Census data shows a trend of dwindling home ownership rates among younger Australians. In 1971, 64% of those aged 30 to 34 owned a home, but by 2016, this had dropped to 50%. Among those aged 25 to 29, the rate of ownership declined from 50% in 1971 to 37% in 2016.

Figure 2: Rate of Australian home ownership by birth cohort and age group

As owning a home has become out of reach, Australians in this age cohort now comprise the core of what is called ‘generation rent’, according to a study for the Australian Housing and Urban Research Institute. It found that the share of those still living with their parents rose from 14% in 2003–04 to 20% in 2015–16.

“The average young person today faces challenges their predecessors did not: wage stagnation and rising underemployment, large government net debt and growing pressures on government budgets driven by increased government spending on pensions and healthcare for older households,” says Hugh Miller, a co-author of the Actuaries Institute report.