Small and medium-sized enterprises (SMEs) in Australia are increasingly turning to alternative financing options as they seek a faster and simpler onboarding process. According to the latest SME Growth Index report from ScotPac, the preference of these businesses for non-bank borrowing reached a record high of 47% in the first quarter of 2023. This was a significant increase of 50% compared to the previous year.

The growing trend comes as lending to SMEs by some major banks is in decline. For instance, the National Australia Bank, the largest business lender in Australia, reported a growth rate of 7.3% in its SME lending in the year ending February 2023. This was down from the 10.5% growth reported in the previous 12-month period to September 2022.

The ScotPac report identifies compliance time and effort, personal security requirements and strict bank lending criteria as Australian SMEs’ biggest challenges to obtaining finance. These barriers might be driving some of them to seek more accessible financing options to support their growth.

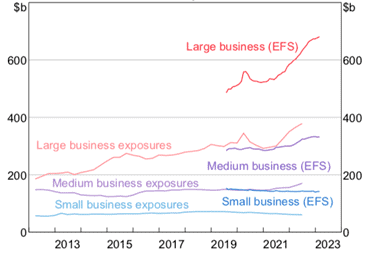

Figure 1: Lending to Australian businesses

* EFS stands for Economic and Financial statistics.

Source: Reserve Bank of Australia, Chart Pack May 2023

According to the report, SMEs that experience a slowdown in their growth rate are more likely to turn to non-bank lenders, with almost 90% of them choosing to move away from traditional banks. Of participating SMEs, about 23% opted for non-bank lenders due to the ease of onboarding, while 20% did so to avoid using non-property assets as security.

Small business owners may also be turning to non-bank financing due to the property barrier, as 16% of them reported seeking non-bank lending to avoid using property as collateral.

Increased business investment

SME owners are still looking to invest in their businesses, despite the current climate of rising interest rates, surging inflation and slowing economic growth, according to ScotPac CEO Jon Sutton.

“That is great news for our broader economy as SMEs are the biggest employers in the country,” he says.

The report found that 60% of SMEs are planning to invest in their businesses in the next six months, up from 55% in March 2022. This is consistent with recent data from the Australian Bureau of Statistics, which shows that the initial capital expenditure plans of Australian businesses in 2023–24 are 11% higher than those from the previous financial year.

Opportunity for brokers

However, the challenge of obtaining finance remains, especially as interest rates continue to rise and make funding more costly. Around 10% of SMEs surveyed by ScotPac reported not knowing how to fund new business investment.

This presents an opportunity for finance and other brokers to work with SMEs that may be struggling to secure capital through traditional channels. By offering a wider range of financing options, such as non-bank lending and asset finance, brokers can help business owners get funding.

“When you couple growing demand for non-bank lending with the time pressures faced by small and medium business owners, the role of the business broker has never been more important,” says Sutton.