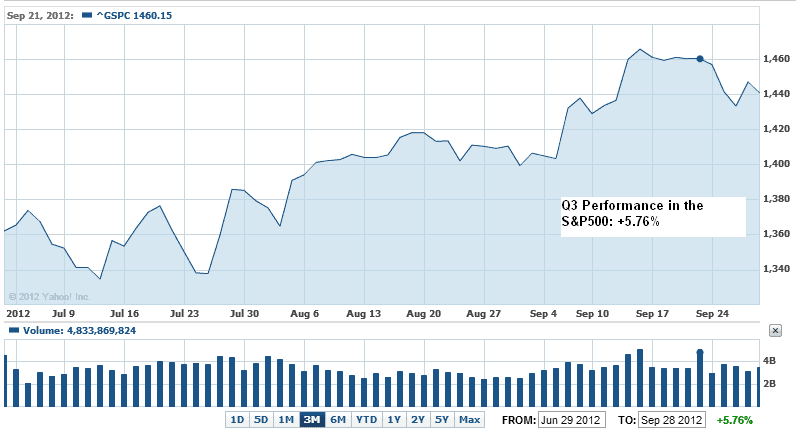

Stock Markets around the globe ended the September quarter in positive territory, as supportive central bank activities generated a strong bullish reversal in equity prices. For month of September, all three US market indices were higher, with the S&P 500 rising 2.4%, the Dow Jones Industrials up by 2.6%, and the Nasdaq advancing 1.6%. But looking more broadly (on a quarterly basis) even stronger performances could be seen, with the S&P 500 higher by nearly 6% during the period as US equity markets posted their best 3rd quarter performance since 2010. The Dow and the Nasdaq were also higher (rising by 4.3% and 6.2%, respectively) with bullishness in the Nasdaq (the star of the group) due in large part to added optimism from Apples latest release, the iPhone5.

Most of this strength in stock prices was generated by announcements from the US Federal Reserve, which signaled its intention to increase market liquidity by purchasing mortgage-backed securities in an effort to kick-start real estate markets as well as the broader economy. These purchases are set to be valued at US$40 billion each month, and global investors took this as a justifiable reason to push stock prices back toward their yearly highs. This latest bull-move has lifted the US benchmark stock index to an increase of 17% year-to-date and the S&P managed to hit its highest valuation levels in 5 years during the month of September.

Here, we can see the quarterly performance in the S&P 500:

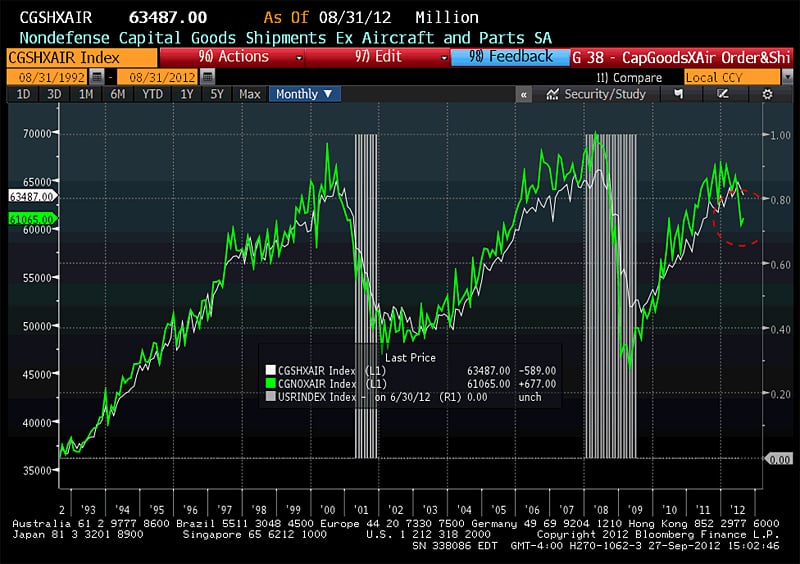

Weakness in Economic Data

Part of the rationale for these skeptical opinions is coming from the weak economic data released this month which showed declines in several key areas but was met with stock prices surging to new highs. The most critical examples could be seen in the US 2nd quarter GDP release, Durable Goods Orders and Chicago Purchasing Managers’ Index (PMI), all of which came in well below market expectations.

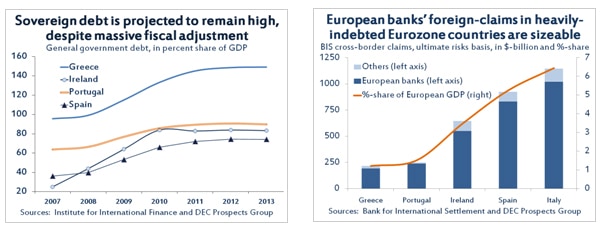

Spain Continuing to Make Headlines

Even with these negative economic releases, there are some positive stories out of the Eurozone, with the Spanish government passing its controversial 2013 budget plan, in accordance with EU bailout requirements for additional loan disbursements. Given the attention that has recently been paid to Spain, the developments were encouraging as these agreements will make it easier for Spain to ensure outside loan funding and to guard against credit defaults.