More older Australians are carrying the heavy burden of mortgage debt into retirement, causing them psychological distress. This suggests a growing risk of failure to meet mortgage payments on time.

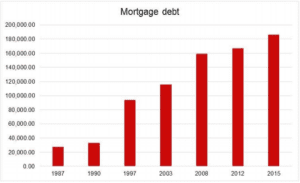

According to a new study, the average mortgage debt of Australians aged 55 and above soared 600% – from $27,000 in 1987 to nearly $186,000 in 2015. Among older homeowners, the proportion of those still paying off their mortgage doubled to 28% over this period, said researchers of the study for the Australian Housing and Urban Research Institute (AHURI).

Figure 1: Mortgage debt for Australians aged 55 and above

“We’re also seeing these older Australians’ mortgage debt burden increase from 13% of the value of the average home in the late 1980s to around 30% in the late 1990s when the property boom took off, and it has remained at that level ever since,” said Rachel Ong ViforJ of Curtin University, lead author of a report based on the study.

Income growth falls behind

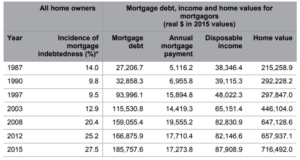

Older mortgagors have found it increasingly hard to meet repayments as their average mortgage-debt-to-income ratio tripled from 71% to 211% between 1987 and 2015. The study estimates that on average, annual repayments rose from $5,000 to $17,000 over the period.

Older homeowners’ income growth has lagged behind their mortgage debt levels and only doubled between 1987 and 2015, according to the report. Data from the Australian Bureau of Statistics shows that of the nearly three in four indebted households in 2017–18, 28% were servicing a total debt that was three or more times their annual disposable income. Most of this debt related to property ownership.

The steep rise in the mortgage-debt-to-income ratio reflects a sharp increase in repayment risk among older mortgage holders, according to the report. And this raises the chances they will struggle to pay their mortgage on time.

Figure 2: Trends for mortgagors aged 55 and above

Mental health suffers

As older mortgage holders face payment difficulty, their stress levels increase and wellbeing declines. Their mental health and psychological distress scores are markedly lower than those of outright homeowners.

“These mental health effects are comparable to those resulting from long-term health conditions,” said ViforJ.

Notably, women suffer more than men. The study’s psychological surveys found that mortgage difficulties reduce mental health scores by around 2 points for older men and 3.7 points for older women.

“Older female mortgagors’ mental health is more sensitive to personal circumstances than older male mortgagors,” said the researchers. “Marital breakdown, ill health and poor labour market engagement all adversely affect older female mortgagors’ mental health scores more than men’s.”

Potential outcomes

Older Australians are likely to have longer working lives and use their superannuation savings to pay off mortgages as they deal with indebtedness, the report noted.

The researchers found that as older homeowners’ average super balances dropped from $471,000 in 2010 to $271,000 in 2014, their average equity stakes in property increased from $621,000 to $667,000. This suggests that older retired mortgagors are drawing down their super savings for use in property purchases.

While older Australians may be willing to work longer to pay off loans, shocks such as unemployment and ill health might keep them from working and earning later in life. Such setbacks can push those with overly optimistic expectations into serious mortgage stress, the report stated.

“It is therefore important for policy makers to consider measures to assist older mortgagors to hedge exposure to mortgage payment difficulties.”