Australia’s housing market has faced significant challenges in recent months, with higher borrowing costs and cooling property values impacting residential markets in some state capitals. But record housing sales now suggest the market is quickly regaining its footing.

According to the latest Pain & Gain report from CoreLogic, Australian home sellers enjoyed unprecedented profitability and dollar-value returns over the December 2024 quarter.

The median nominal gain from housing resales during this period reached $306,000 – the highest since CoreLogic began its report series in the mid-90s.

Resilience amid mixed conditions

A slip in home values also caused a slight increase in the proportion of Australians making a loss when reselling their property. During the quarter, 94.8% of sellers achieved a nominal profit across Australia, a marginal dip from 95.1% in the previous quarter.

This slight decline in profit-making resales coincided with a –0.3% drop in national home values at the end of 2024.

“This subtle increase in loss-making sales makes sense because any decline in real estate values increases the chance of loss-making sales occurring,” noted Eliza Owen, CoreLogic’s Head of Research.

Despite this shift, total nominal resale gains rose to $35.6 billion, up from $35.0 billion in the previous quarter. As Owen pointed out, this bounce-back – following the Reserve Bank of Australia’s decision to start cutting interest rates in February this year – augurs well for home resales prospects.

“Given the strong relationship between capital growth and the rate of profitability and expected further easing in the cash rate this year, the rate of profitability from home resales will likely recover in 2025,” she said.

Diverging regional trends

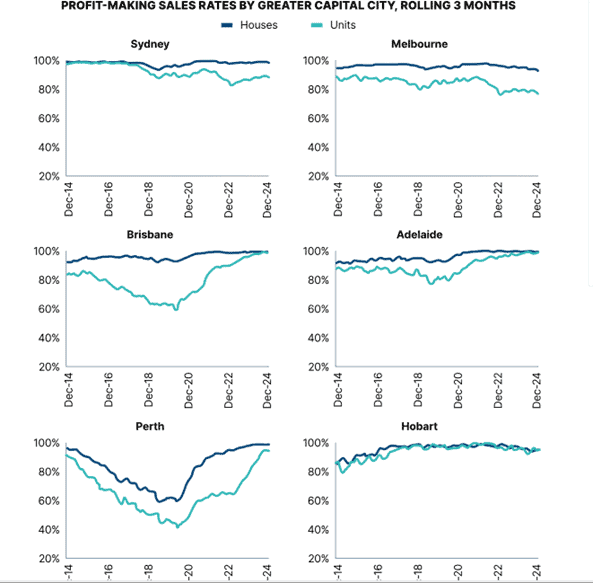

Investors have also had to navigate varying trends across Australia’s capital cities.

Between September and December 2024, Brisbane claimed the top spot for profit-making resales in Australia, with almost all resales (99.6%) making a nominal gain. Adelaide was a close second, followed by Sydney, Melbourne, Hobart and Canberra.

For the 5.2% of resales that incurred a loss, the median loss rose to $45,000 – up from $40,000 in the previous quarter and exceeding the five-year average of $39,180.

Sydney and Melbourne accounted for 60.6% of all loss-making resales despite representing only 34.2% of total resales in the quarter.

Source: CoreLogic, Pain & Gain report, March 2025

Units account for most resale loss

Units were the primary source of resale losses, making up 47.2% of all loss-making resales nationwide. Together, Sydney and Melbourne’s unit markets contributed nearly one-fifth of all loss-making sales in Australia.

In contrast, houses were far less likely to see a loss, with only 3.0% selling for less than the previous price.

This disparity can be traced back to a surge in unit developments during the early-to-mid 2010s, driven by strong investor demand for off-the-plan apartments. However, as lending conditions tightened in the late 2010s, demand waned while unit supply remained high.

“The result has been much stronger growth in houses nationally in the past decade than units, at 80.5% and 38.5% respectively,” Owen added.

Tight supply impacting recovery

How long will this growth continue, given that affordability remains challenged and supply tight? Recent research by Mandala Partners, commissioned by the Property Council of Australia, projects a shortfall of approximately 462,000 homes against the Albanese government’s target of constructing 1.2 million new, well-located homes by 2029.

Ongoing construction challenges – including labour shortages and rising material costs – are driving up the cost of new dwellings and exacerbating the supply-demand imbalance. As a result, property prices and rents in capital city markets are expected to remain under upward pressure.

Ongoing debates about taxation policies, such as stamp duty reforms, could also influence market dynamics and crimp investors’ enthusiasm.

Yet, as Matthew Hassan, Head of Australian Macro-Forecasting at Westpac, put it, grounds for optimism remain. “Our view … is that the housing upturn will see another modest leg higher, with the impetus coming from lower interest rates, but relatively subdued gains given the high starting point for prices and relatively shallow RBA easing cycle,” he said in a recent report.

As the Australian housing market continues to navigate its path to recovery, keeping a close watch on evolving economic conditions and the supply-demand disparity will be crucial.