After the Reserve Bank of Australia’s (RBA) move to resume interest rate hikes and lift the cash rate to 4.35%, all eyes are now on surging wages and their likely impact on inflation. Are borrowers on the brink of more interest rate pain?

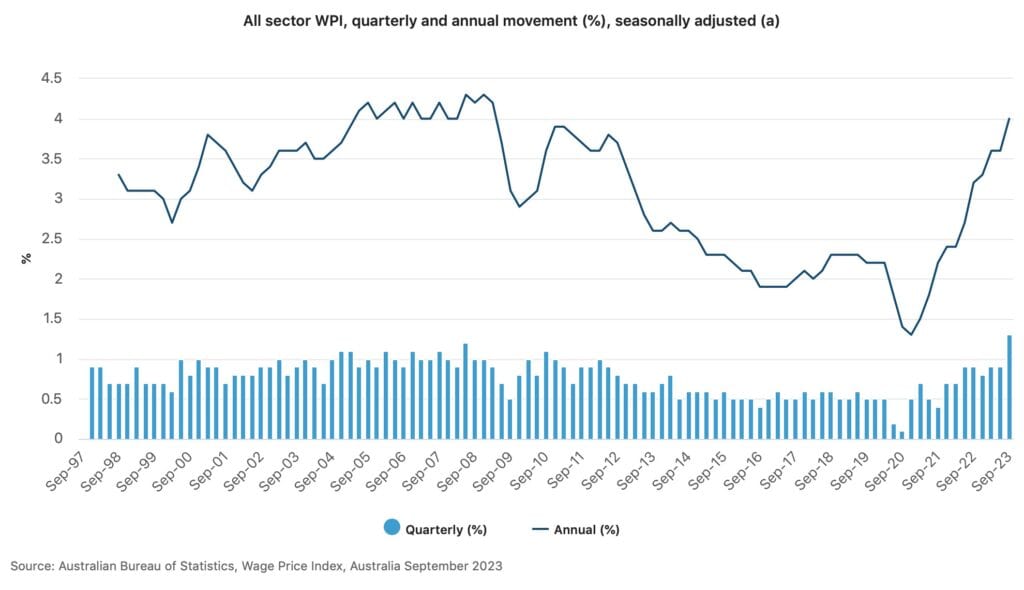

The latest data from the Australian Bureau of Statistics (ABS) shows that wages rose 1.3% in the three months to September 2023 – the highest quarterly growth on record. They grew 4% annually, marking the largest gain since the March quarter of 2009.

Private sector employees received a 4.2% year-on-year rise in wages, while those in the public sector had a 3.5% increase.

Figure 1: Wage Price Index, September 2023

Source: Australian Bureau of Statistics, Wage Price Index, Australia

According to the ABS, a mix of factors drove widespread increases in average hourly wages, including the Fair Work Commission’s decision to raise pay for those on minimum and award wages. A 15% pay hike for aged care workers, a competitive job market, and the factoring of inflation into compensation reviews also contributed to the increase.

In the public sector, “Jobs were affected by the ending of state wage caps and the resolution of wage negotiations,” said Michelle Marquardt, ABS Head of Prices Statistics.

“This resulted in initial or backdated increases being paid for jobs covered by the newly approved enterprise agreements.”

Productivity strain and inflation risk

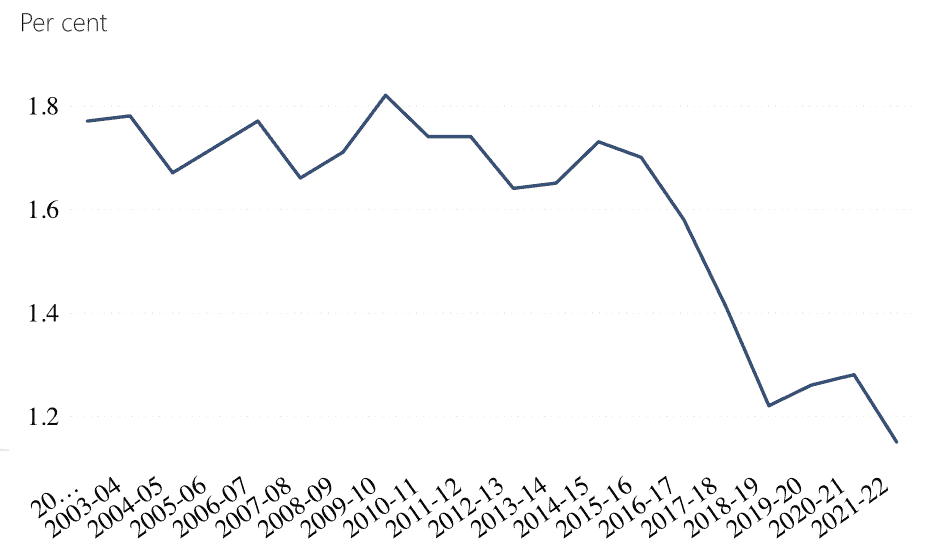

Economists caution that the surge in wages could drive further inflation and pressure the RBA to raise interest rates unless productivity improves significantly.

According to Citi Australia’s Chief Economist Josh Williamson, productivity must grow by around 1.25% annually to align with the RBA’s 2–3% inflation target. “However, productivity growth is negative at the moment. Furthermore, the risk is that wages growth remains stickier for longer.”

Figure 2: Labour productivity growth over the past 20 years

Source: Department of the Treasury, Measuring Productivity

Government data shows that labour productivity has slowed since the mid-2000s, growing at around 1.2% over the past 20 years to 2021–22. In contrast, the consumer price index rose 5.6% in the 12 months to September 2023, largely driven by price increases in housing, transport, and food and non-alcoholic beverages.

Low chance of a December rate hike

While wage pressures are anticipated to stay high in coming months, the latest figures are not expected to prompt an interest rate increase at the RBA’s December 2023 board meeting.

ASX’s RBA Rate Indicator currently indicates only a 2% probability of the official cash rate rising to 4.60% in December. As of November 15, the ASX 30 Day Interbank Cash Rate Futures December 2023 contract was trading at 95.675, reflecting this expectation at the next RBA board meeting.

“We don’t expect [the latest] data will change the RBA’s thinking ahead of its December meeting, where we expect the RBA to hold the cash rate at 4.35%,” said ANZ economists Catherine Birch and Madeline Dunk in a note.

“Given [that the wage growth] was partly driven by temporary factors, it will not concern the RBA as much as would be expected on face value,” they added.

According to CommSec Senior Economist Ryan Felsman, the RBA anticipated the rise in wages in the third quarter of 2023.

“With Aussie annual wage growth still lagging consumer prices and the RBA’s cautious communication [of its latest monetary policy decision], investors appeared to doubt whether this [wage] report alone would trigger a further tightening in monetary policy, pricing just a 7% chance of a follow-up hike in December,” said Felsman in a report.

“In fact, money markets shrugged off the stronger-than-expected annual WPI print, instead focusing on US consumer inflation data, which overnight came in weaker than anticipated. Traders are now pricing in a 50% chance of the RBA raising interest rates by May next year.”