New loan activity wanes but refinancing soars

With the Reserve Bank of Australia (RBA) increasing the cash rate from 0.1% in April to 3.1% in December, high levels of home loan refinancing activity show no signs of abating.

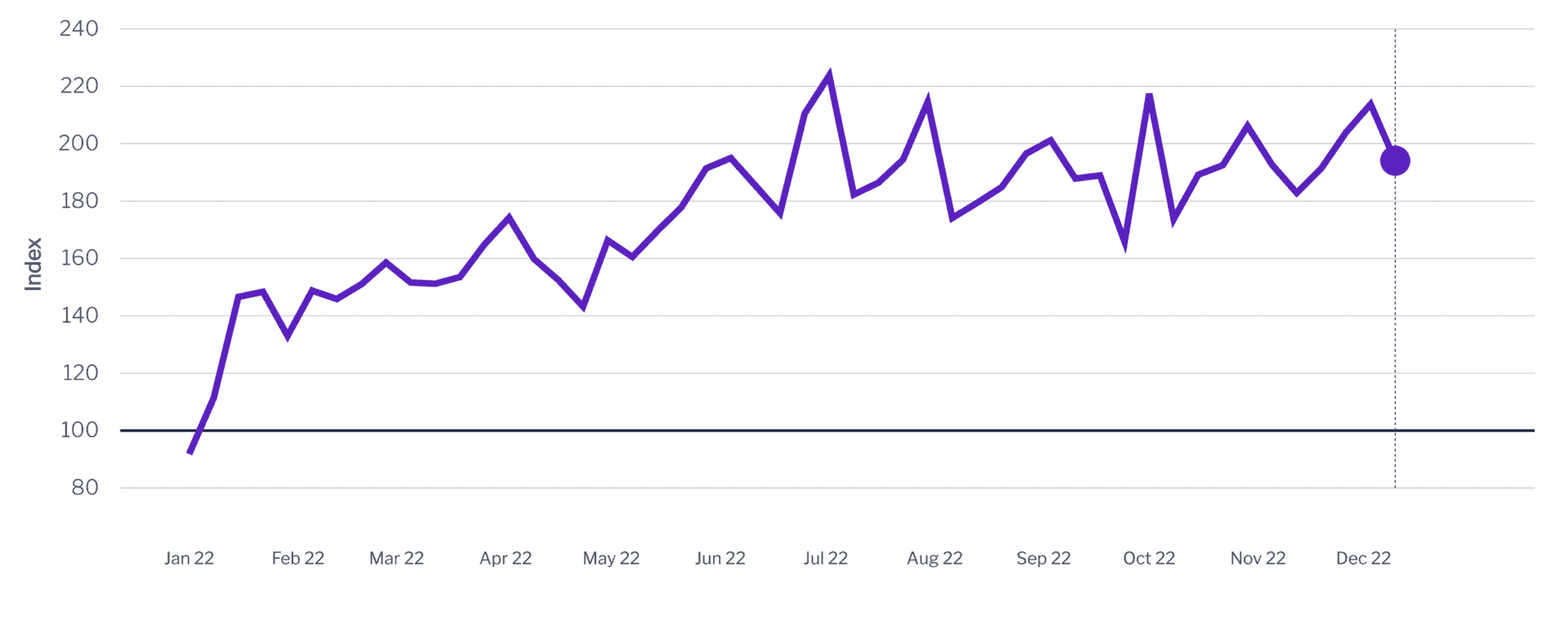

Data from online property exchange PEXA confirm the trend. In fact, the PEXA Refinance Index for the week ending 6 December hovered close to its September 2022 peak of 179.5 points.

Figure 1: Volume of refinances across Australia

Source: Pexa Refinance Index, 13 December 2022

In December, the RBA indicated that a further increase in inflation is anticipated in the early months of 2023. It therefore expects to “increase interest rates further over the period ahead”.

In a recent article, PEXA’s Chief Economist Julie Toth suggests the transmission of interest rate rises to borrowers will continue to negatively impact the disposable income of variable rate–mortgage holders into the new year.

“PEXA’s research indicates that rising interest rates are driving record numbers of borrowers to refinance their loans,” Toth says.

“Our consumer research confirms a strong appetite for Australians to shop around for the best loans possible. This is warranted, given that consumers can save an estimated $1,524 per year on average by seeking out new financing options. This is in addition to cash-backs and other incentives being offered to refinancers by major home loan providers.”

The size of refinance loans is also increasing

The Adviser reports that the size of home loans accessed for refinancing is also rising.

The article cites data from Joust’s Live Auction service, which indicates a 6.15% increase in the size of ‘refinance’ loans across Australia, from $508,838 in October 2021 to $540,149 in October 2022.

In the report, Joust Chief Executive Carl Hammerschmidt says that there are now “clear signs” borrowers were not initially prepared for the 2022 rate increases.

According to Hammerschmidt, “the increase in people across most states looking to refinance larger home loans shows that those who got into the market during record low interest rates are now finding themselves over-extended”.

The size of new loans is falling

At the same time, there appears to be fewer new loans granted for residential and commercial property purchases. New homeowners are likewise taking out smaller loans.

Joust data reveals a 16.97% fall in the size of home loans accessed by the online marketplace’s ‘buy’ category, decreasing from $725,586 in October 2021 to $602,430 in October 2022. Loan sizes in the ‘build’ category also dropped 11.17%, from $767,243 to $681,538.

Toth notes that renters who aspire to home ownership may be happy to see house prices fall, but their maximum loan size is becoming progressively smaller as rates increase.

“We are now seeing fewer people moving from renters to first home owners, and at lower average price points. This places further pressure on rental markets, at a time when rental availability and affordability are at record lows in many locations,” Toth says.

A year to refinance?

According to Loan Market’s Senior Finance Specialist Brett Richardson, 2023 will be a year of refinancing.

“[The year] will see mortgage holders looking to refinance to a lower variable rate or will consider fixing for certainty. Households will need to direct more money towards mortgage repayments and have less disposable income,” he says in a report by The Property Tribune.

“With the higher cost of living and mortgage repayments continuing to increase in 2023, inflation will continue to be higher. This could see mortgage stress, with property prices possibly declining.”

Mortgage brokers, in particular, should be aware of the challenges and opportunities the new year will bring.