Borrowers are rushing to refinance their home loans as the reality of rising interest rates kicks in. With major banks passing on the Reserve Bank’s recent rate rises in full, smaller providers are becoming customers’ lenders of choice.

According to a recent Finder survey, 18% of participating mortgage holders refinanced their home loans in the past six months. Another 18% are planning to do the same in the next six months.

“Households are in a very precarious position right now, struggling with the worst cost-of-living crisis in decades,” says Sarah Megginson, Head of Editorial at Finder. “For some, it’s a case of refinance or default on their debt.”

Total refinanced loans already hit a record high of $19 billion in May, when the Reserve Bank lifted the cash rate for the first time in almost 12 years. According to Finder’s analysis, this represented an increase of 20% over the year.

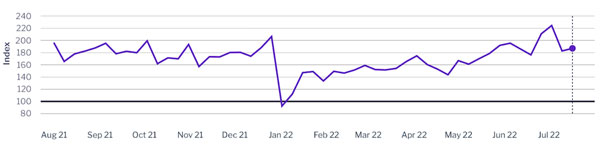

Figure 1: Volume of refinances across Australia via PEXA’s platform

Source: PEXA Refinance Index, July 2022

Recent data from online property exchange PEXA confirms that refinancing is booming. In early July, the number of refinancing deals lodged through its platform rose by 16% over the year – and by nearly 29% over the quarter.

Queensland had the highest increase out of all the states, with a year-on-year increase of 34% and a quarterly growth of 26%.

Banks lose out to smaller lenders

As borrowers hunt for lower rates, they are increasingly turning away from the major banks and towards smaller lenders, according to PEXA Head of Research Michael Gill. This is especially noticeable in the major markets of New South Wales and Victoria.

“If you look back to the start of the pandemic, the major banks were quite successful in winning more refinancing,” says Gill. “Obviously, those fixed rates motivated many borrowers to move across.”

Data from comparison site Mozo shows that the big four banks’ one-year fixed rate now averages 4.80% per annum, higher than the 4.71% among all the lenders tracked by Mozo. For a five-year term, the big four’s average is 6.34% per annum compared to Mozo’s 6.09% average for all lenders.

For comparison, the one-year fixed rate of lenders in Mozo’s database averaged 2.60% in March 2022, and their rate for a five-year term averaged 3.83%.

“Fixed rates are basically out of the market now,” says Mozo banking expert Peter Marshall. “The big banks are certainly not trying to attract customers with their fixed rates, so they’re looking at what they can do to get people in the door and give them their loans.”

Mozo consumer advocate Tom Godfrey believes mortgage holders can save tens of thousands by shopping around and switching to lenders with better deals.

“Given the savings on offer, it’s hardly surprising we’re seeing a shift to challenger lenders [and] away from the big four banks.”

An opportunity for brokers

Mortgage brokers have an important role to play in this fast-changing market. With their knowledge of mortgage products, they can help clients make the right decision when switching to another lender or home loan.

“Some people may be unaware that they are on a standard variable rate, which will fluctuate more if not properly looked at or managed,” says Joseph Daoud, Co-founder of broker Simple Finance. “They should look at their statements and see how much their rate has increased and look to refinance from this position.

“It’s best to get in touch with expert brokers to help them evaluate their best choices.”