Home values in Sydney and Melbourne have dipped for the first time in nearly two years, following a period of rapid growth. With house prices outpacing incomes and persistently high interest rates, could this signal a cooling market?

According to recent data from CoreLogic, Sydney’s home values declined by 0.1% in October, the city’s first downturn since January 2023. CoreLogic Research Director Tim Lawless sees this as a potential sign of market recalibration.

“The housing market is levelling out, with both Sydney and Melbourne now moving into a shallow downturn,” he said in a report.

High-end properties in Sydney have been particularly affected, with values among the city’s most expensive homes falling by 0.6% in October. Melbourne also recorded a dip, down by 0.2%.

Subtle downturn expected

Lawless expects the downturn in the two capital cities to be mild.

“It does look quite shallow to me, with housing prices likely to be supported by the ongoing lack of new supply and potentially by interest rate cuts next year invigorating the market,” he said.

He added, however, that lower interest rates alone may not trigger a full rebound. Instead, they could prompt discussions on macroprudential measures to prevent excessive debt, which could keep housing activity restrained.

The Australian Prudential Regulation Authority (APRA) has previously tightened lending standards to curb risky borrowing.

Market observers believe a similar intervention might be needed again to address high household debt levels, especially given that mortgage loans account for about two-thirds of banks’ domestic lending. In this context, it is notable that APRA has maintained its 3% interest rate buffer to manage borrowing risks despite calls from banks to reduce it.

“I wouldn’t be surprised if we did see another round of macroprudential focus,” said Lawless.

Melbourne’s affordability advantage

With prices that remain more affordable than in Sydney, Melbourne may become increasingly attractive to buyers – especially if the gap continues to widen between the two markets.

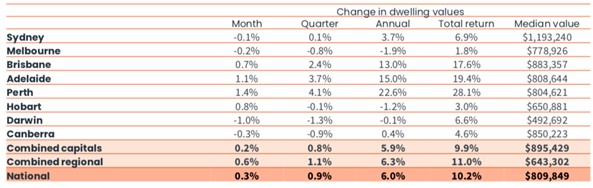

Recent data from CoreLogic reveals that Sydney’s median home value in October was $1.19 million, 53.2% higher than Melbourne’s $778,926. This marked the largest gap in more than 20 years.

Change in Australian housing values, October 2024

Source: CoreLogic, Hedonic Home Value Index, October 2024

But as more Australians move to Melbourne to take advantage of its lower property prices, the demand could narrow the price difference between the two cities.

Victoria continues to attract interstate migration, with data from removal company Muval showing that Melbourne accounted for 30% of all capital city relocations during February and April 2024.

“We could be at the peak width of this gap at the moment, given this competitive advantage Melbourne’s accruing in terms of affordability and higher rental yields and attractiveness for first home buyers,” said Lawless.

Slowing growth momentum for mid-sized cities

While Australia’s two largest housing markets show signs of stabilising, mid-sized cities are still experiencing growth, though at a slower pace.

Perth saw the strongest increase nationally, with home values up 1.4% in October. This was down from the more than 2% monthly growth rates recorded from February to June. Similarly, Adelaide’s monthly gains have consistently exceeded 1% since March, but the 1.1% rise in October was the lowest since June.

These cities are also seeing a slowdown in their price growth trajectory, according to Lawless.

“Despite the rise in listings across the mid-sized capitals, Perth, Adelaide and Brisbane are still seeing advertised stock levels more than 20% below the five-year average for this time of the year,” he said. “These markets remain well and truly in favour of sellers, although the balance is starting to gradually improve.”