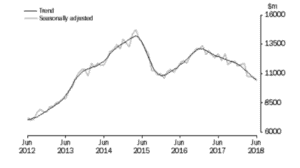

Demand for housing loans continues to weaken as investors have been forced to pull back from the Australian property market. Investor home loan commitments fell to $10.4 billion in June 2018, a reduction of 18.1% from a year ago and 2.7% from the previous month. It was the lowest monthly total in almost five years and could signal further trouble for house prices, which have already fallen 1.6% in the year to July 2018.

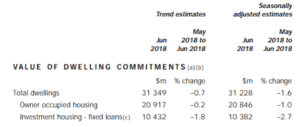

Sluggish investor activity is driving declines in total housing loans. Data from the Australian Bureau of Statistics (ABS) shows that total housing finance commitments in June eased 1.6% from the previous month to $31.2 billion, the lowest total value since January 2016.

Figure 1: Total value of investment housing commitments

Housing investors are most affected

The Australian Prudential Regulation Authority (APRA) has introduced stricter lending policies in recent years, which have hit the home investment segment the hardest. These policies include stringent mortgage serviceability requirements and limits on interest-only lending. The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry has also had an impact, affecting the availability of finance for home investors. J.P. Morgan analyst Henry St John said, “From the demand side, continued depreciation in property prices continues to erode the expected rate of return on new property investments, reinforcing the feedback loop between new lending and property prices in Sydney and Melbourne.”

Home values in Sydney and Melbourne continue to fall. Sydney suffered the sharpest drop among the capital cities, at 5.4% in the year to July 2018, while prices in Melbourne dipped 0.5%, data from property consultant CoreLogic shows. Across the country, home prices eased 0.6% in July from June, their largest monthly fall since late 2011.

Economists have attributed falling house prices to the tightening supply of credit, which has made accessing loans particularly difficult for property investors. Lenders have cut back investor home lending since APRA started clamping down on higher-risk lending a few years ago.

Although APRA has removed the 10% cap on investor loan growth that it introduced in 2014, it is replacing it with more permanent measures. These include requiring lenders to set limits on the proportion of new lending at high debt-to-income levels. Analysts expect these limits to significantly affect credit growth over the medium term. Given the tightening credit supply, they don’t foresee a rebound in property investment activity anytime soon.

Owner-occupier financing also dips

While investors have driven the general slowdown in home financing commitments, demand from owner-occupiers has also been easing. ABS data shows that the value of loan commitments from owner-occupiers fell 1.0% to $20.8 billion in June, with the total number of commitments declining 1.1% to 52,181.

Figure 2: Total home financing commitments

Despite the decline in owner-occupier demand, first-home buyers are gaining strength. ABS data shows that first-home buyers accounted for 18.1% of total owner-occupier finance commitments in June 2018, up from 14.9% in June 2017.

First-home buyers are also taking out larger mortgages. Their housing loans averaged $349,800 in June 2018, up more than 10% from $317,700 a year ago. Between May and June 2018 alone, their average loan size increased by $5,200.

However, the fact that first-home buyers – who often have relatively little equity – are entering a declining market and borrowing larger amounts to do so is somewhat concerning, according to Cameron Kusher, Head of Research at CoreLogic. “With [housing] value declining, they run a significant risk of seeing their overall wealth decline,” he said in a recent note.