Despite record low interest rates and government incentives to encourage lending, many small businesses are struggling to access credit. In fact, the supply of finance remains tighter than before the pandemic, particularly for hardest-hit businesses, according to the Reserve Bank of Australia (RBA).

“While there are signs that conditions have started to improve a little recently, surveys of small businesses indicate that access to finance remains difficult,” said RBA Assistant Governor Christopher Kent in a recent speech.

About 40% of regional businesses and 35% of those in capital cities surveyed by Sensis said it was tougher to access small business loans since the start of the pandemic. Overall, 37% of respondents believed it became harder to access finance – with more than one in four (26%) reporting they received a rejection when they applied for finance.

Members of RBA’s Small Business Finance Advisory Panel have expressed similar sentiments.

“A consistent and ongoing theme is that smaller businesses find it a challenge to access finance,” noted Kent.

“Entrepreneurs in our small business panels have noted that access to finance for startups is a challenge, banks often have substantial collateral requirements, and the process for getting finance is lengthy and onerous,” he added.

Not a new trend

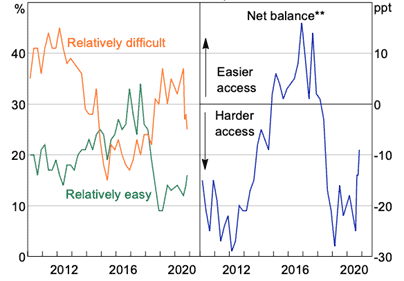

While the supply of credit tightened in response to COVID-19, small businesses have for years reported finding it challenging to access finance, as Figure 1 shows.

Figure 1: Small businesses’ perception of their access to finance*

* Since July 2019, the survey has asked about perceptions of changes in access to finance relative to a previous period. Before that, it asked for point-in-time assessments. ** Net balance is the difference between the percentage of firms indicating access is relatively easy and the percentage of those saying that access is relatively difficult.

Source: Reserve Bank of Australia using data from Sensis

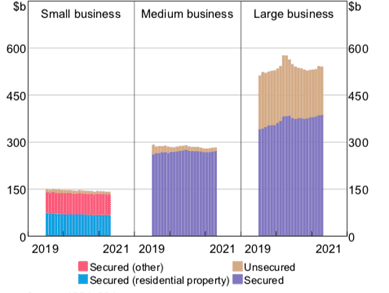

Lending to businesses also shows a big disparity between small and larger firms. While lending to small enterprises slightly fell since the onset of COVID-19, lending to large businesses notably increased during the early stages of the pandemic.

Figure 2: Lending to businesses

Source: The Australian Economy and Financial Markets Chart Pack, June 2021

Judo Bank recently highlighted a widening gap in lending to small and medium-sized enterprises (SMEs). Its research shows that SMEs with a turnover of $1 million to $20 million had a lending gap of $94.3 billion in 2020, up $4.6 billion from the previous year.

According to Kent, one factor weighing on SME lending is banks’ more cautious approach to deciding whether to finance smaller businesses.

“Much of this has reflected the application of pre-existing lending standards in a weaker economic environment. But lending standards have also been tightened,” he said, citing banks’ more stringent processes of verifying borrowers’ information as an example.

At the same time, research from RBA indicates that some businesses have been reluctant to take on more debt due to economic uncertainty. Many have also taken advantage of stimulus and other programs to support their cash flows, reducing their need to access funding from banks and other lenders.

Opportunities for brokers

Still, many businesses continue to require external funding, especially as the economy recovers and they try to expand their operations. With some of them struggling to get access to credit, brokers have an opportunity to help these businesses navigate the lending market and provide them with options.

One area of opportunity for brokers is the growing number of homegrown businesses that are moving production back to Australia. According to a recent survey by technology firm PROS, more than one in two manufacturers (55%) intend to bring operations back to Australia by 2023 following market uncertainty caused by the pandemic. Nearly one quarter (22%) of respondents have already ‘reshored’ their operations, with almost half of their manufacturing capacity expected to return home.

This reshoring trend could bring billions of dollars to the local economy over the next five years, according to Jens Goennemann, Managing Director of the Advanced Manufacturing Growth Centre.

“Manufacturers are seeing the value in doing things better and being globally competitive on home soil,” said Goennemann.