Small and medium-sized enterprises (SMEs) are turning to non-bank lenders as funding through banks becomes increasingly out of reach.

Accessing business loans through traditional bank borrowing has become tougher since major banks started tightening their serviceability requirements in response to the Australian Prudential Regulation Authority’s (APRA’s) measures. APRA has called on banks to review their serviceability metrics and ensure they are set at appropriate levels based on current conditions. Although changes in APRA’s guidelines were meant for residential mortgage loans, they have affected banks’ SME lending.

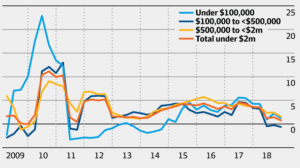

According to The Australian Financial Review, its analysis found negative growth in bank business loans of between $100,000 and $500,000 for the last three quarters ending March 2019. Growth in these loans dropped by 0.5% in the December 2018 quarter, the weakest annual rate in seven years.

Now reports show that many SMEs are seeking greater flexibility through alternative lenders such as finance companies and fintech players.

Figure 1: Annual change in business loans by size

For example, research by banking analysts East & Partners for lender Scottish Pacific found that the number of SMEs turning to their main bank for funding has dropped below the 20% mark, to 19.5%, for the first time in five years. The Scottish Pacific SME Growth Index for March 2019 reveals that SMEs looking to finance growth are almost as likely to approach a non-bank lender as they are to ask their main bank. Nearly 18% of participating business owners identified non-bank lenders as their first choice when it comes to funding growth – up from 15% six months earlier.

Non-bank lending is picking up

Data from Commonwealth Securities (CommSec) also confirms that non-bank lending is gaining steam. Loans and advances by non-bank lenders rose by 11.4% over the year to September 2018, up from the annual growth rate of 10.3% recorded the previous month. This was the strongest annual growth in non-bank lending in 11 years.

On the other hand, loans and advances by banks grew by only 4.9% over the year to September 2018, up from the 4.7% annual growth rate recorded the previous month. Bank lending grew by just 4.6% over the year to July 2018, its slowest annual growth rate in 26 years.

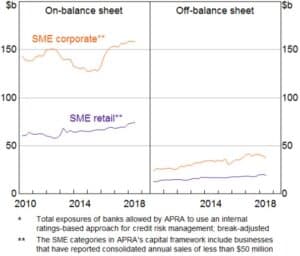

Figure 2: Small-business lending by Australian banks*

Non-bank lenders to be the main funding source

If the current trend in non-bank lending continues, East & Partners expects alternative lenders to overtake banks as SMEs’ main source of funds for new investment by the second half of 2020.

The Scottish Pacific SME Growth Index shows that 96% of SMEs prefer alternative lenders, mainly because they involve faster credit approvals and less stringent compliance requirements. They also allow business owners to borrow funds without needing to use their home as security.

By contrast, taking out a business loan from a bank typically involves providing property – usually the family home – as collateral. But as house values have declined, this practice has put many SMEs at risk. That’s because entrepreneurs have reduced levels of equity to prop up their businesses. To avoid the stress related to the housing market downturn, SME owners are increasingly exploring alternative routes to funding their business expansion.

According to Scottish Pacific CEO Peter Langham, SMEs’ dislike of putting up property as security is one reason entrepreneurs are turning to non-bank lenders to fund their business growth.

“Alternative finance is building momentum, underlined by the clear reluctance of business owners to borrow against property,” says Langham. “The SME Growth Index found that nine out of 10 SMEs would be willing to accept a higher interest rate if it meant they didn’t have to provide property security.”