Just as soaring prices bite at household budgets, businesses are dealing with their own financial pains. The costs of debt and doing business are rising, and there’s no more pandemic-related government support to provide some buffer.

According to an Australian Bureau of Statistics survey, 46% of businesses saw an increase in operating costs in June, more than double the share of companies the previous year. An equally high proportion (44%) were expecting operating expenses to climb in July.

But a bigger headache for businesses, especially small ones, is poor cash flow.

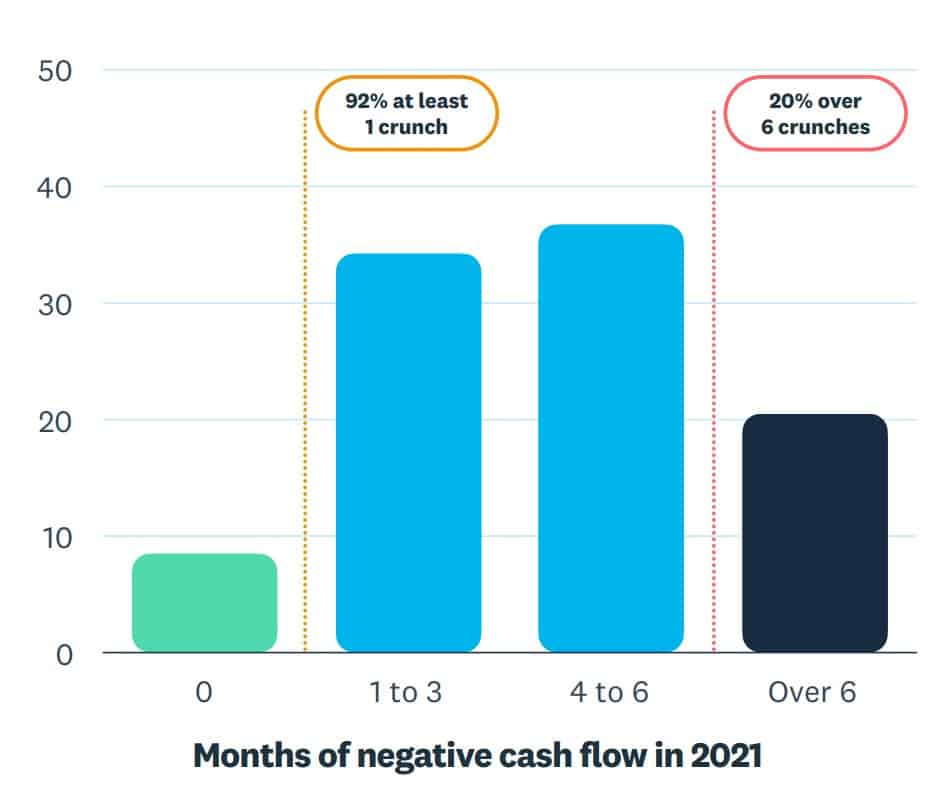

Recent research from accounting software firm Xero found that 92% of small businesses had negative cash flow at least once in 2021. This experience lasted more than six months for one in five companies. On average, Australian small businesses went through 4.2 months of negative cash flow.

Figure 1: Months of negative cash flow among small Australian businesses, 2021

Source: Xero’s Crunch: Cash flow challenges facing small businesses

“The fact that cash flow improved during the pandemic, despite spikes in cash flow crunches at the start of 2020, shouldn’t be a cause for celebration,” says Joseph Lyons, Xero Managing Director for Australia and Asia.

He points out that while government support schemes such as JobKeeper and JobSaver helped buoy cash flow back to pre-pandemic levels, improvements stemmed from businesses slashing expenses – often because they were forced to reduce trading hours.

“Cash flow doesn’t give a full picture of small business health, but it does offer a strong indicator of how much pressure small businesses are facing. And we’ve seen little to no lasting improvement for Australian small businesses even post-pandemic,” says Lyons.

Months of negative cash flow can create serious challenges for small businesses, especially those with limited access to credit, adds Xero Chief Customer Officer Rachael Powell.

“It can lead to mounting expenses, unpaid wages, lost jobs and owners dipping into personal savings and equity to keep their company afloat. If cash flow crunches become a chronic and repeated occurrence, the business will ultimately fail.”

Turning cautious

Small businesses are already trading cautiously. Their average payment defaults were up 18% annually in June, according to credit reporting agency CreditorWatch. Its data shows that average default rates are rising among small businesses.

“We continue to see a disturbing rise in trade payment defaults, our leading indicator for future business insolvencies,” says CreditorWatch CEO Patrick Coghlan. “Court actions are also back to pre-COVID levels.”

CreditorWatch Chief Economist Anneke Thompson believes companies will be increasingly wary of credit customers and their ability to pay going forward.

“Businesses in the growth phase, [which] require equity or debt for growth, may now see these lines of funding get increasingly more difficult to source,” she says.

Conditions still robust but confidence falls

Still, NAB’s recent survey shows that business conditions in general remain strong despite a fall in confidence.

“Conditions strengthened in Q2 [2022] as the disruptions related to the virus receded,” says NAB Group Chief Economist Alan Oster. “Trading, profitability and employment were all higher with conditions approaching the high levels seen in early 2021.”

Forward-looking indicators also look good. “Businesses have high expectations for employment over the coming year, indicating that labour demand remains very strong, and capex expectations also remain elevated.”

Getting help

For small businesses, cash flow doesn’t have to be a persistent problem. By working with a trusted lender, they can better manage their finances and access funding to help them beat cash flow crunches.