Australia’s home values fell for the ninth consecutive month in June and are forecast to decline for the rest of 2018 and throughout 2019, driven by tightening credit conditions. Potential rate hikes from the central bank in the second half of 2019 could also lead to further pressure on property prices.

Continued price falls would increase the likelihood of negative equity among recent buyers, particularly in housing markets such as Sydney and Melbourne, where property prices are high relative to incomes and therefore more sensitive to tougher credit conditions.

CoreLogic’s recent hedonic home value index shows that housing values decreased by 0.2% in June 2018, putting the national decline at −1.3% since the housing market peaked in September 2017.

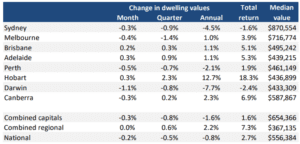

Figure 1: Change in Australian housing values, June 2018

Results for the June 2018 quarter show that national home prices dropped 0.5% as values across the capital cities fell by 0.8%, according to CoreLogic. Of the capital cities, Melbourne saw the most decline over the quarter, at −1.4%, followed by Sydney (−0.9%), Darwin (−0.8%) and Perth (−0.7%). Combined regional markets recorded an increase of 0.6%, helping offset the decline in the capital cities.

Despite the monthly falls, national housing values remain 32.4% higher than five years ago, according to CoreLogic Research Director Tim Lawless. “This highlights the wealth creation that many home owners have experienced over the recent growth phase, but also the fact that recent homebuyers could be facing negative equity,” he said.

Tighter credit is the main culprit

Economists and analysts have attributed the falling housing values primarily to the tightening supply of credit – which has made it difficult to access financing, particularly for property investors. Lenders have cut back investor home lending since the Australian Prudential Regulation Authority (APRA) started clamping down on higher-risk lending a few years ago.

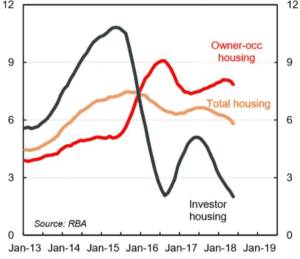

Figures released by the Reserve Bank of Australia (RBA) in June show flat investor housing finance in May 2018, with annual growth hitting a record low of 2%. Property investor lending accounted for only 33.5% of all outstanding housing credit, the lowest since January 2013. Owner-occupier housing credit, on the other hand, went up by 0.6% in May and grew by 7.9% over the year.

Figure 2: Annual change in housing credit (%)

The slowdown in investor property lending has hit Sydney and Melbourne the hardest because of their high concentration of investment housing activity. These cities have experienced the most substantial decline in housing demand, according to CoreLogic.

The stagnant growth in investor housing finance shows that the regulators have been successful in slowing investor demand for home loans, according to Commonwealth Securities (CommSec). “Investor home lending is still growing, but at the slowest pace in 28 years of records,” said CommSec Chief Economist Craig James.

Prices to continue to fall

Housing prices will likely continue declining for the rest of 2018 and into 2019. ANZ has forecast nationwide housing prices to fall by 4% in 2018 and a further 2% in 2019. It expects interest rate hikes from the RBA in the second half of 2019 to contribute to house price declines next year.

Sydney and Melbourne will primarily drive this decline and record peak-to-trough price falls of around 10%, according to ANZ. The high housing values and highly leveraged households of Sydney and Melbourne make them more sensitive to tougher credit conditions and rising interest rates than other places.

These cities – and other markets where property prices are high relative to incomes – could see reduced housing activity as lenders focus more on overall debt-to-income ratios and household living expenses in their serviceability assessment, according to CoreLogic.

APRA has urged lenders to strengthen their assessment of potential borrowers’ expenses and existing debt. It expects lenders to introduce policy and portfolio limits on new lending at very high debt-to-income levels. Analysts anticipate that these new ‘restrictions’ will slow credit growth further and contribute to falling property values.