The Australian Prudential Regulation Authority (APRA) has stepped in to tighten bank lending standards just as the housing market surpassed a staggering $9 trillion in value. As the share of heavily indebted borrowers in banks’ loan books rises, APRA fears growing risks to financial stability.

“More than one in five new loans approved in the June quarter were at more than six times the borrowers’ income, and at an aggregate level the expectation is that housing credit growth will run ahead of household income growth in the period ahead,” said APRA Chair Wayne Byres.

Under the new rules, authorised deposit-taking institutions will have to assess new borrowers’ ability to pay back loans at an interest rate that’s at least 3 percentage points higher than a loan’s rate. This is 0.5 percentage points higher than today’s common housing loan serviceability buffer.

“In taking action, APRA is focused on ensuring the financial system remains safe, and that banks are lending to borrowers who can afford the level of debt they are taking on – both today and into the future,” Byres added.

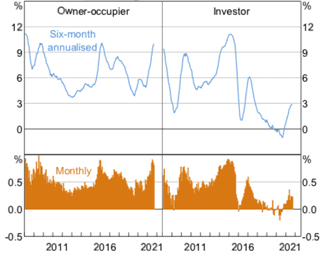

Figure 1: Australian housing credit growth

Source: Reserve Bank of Australia Chart Pack, October 2021

Impacts of the new rule

APRA estimates the higher buffer will reduce maximum borrowing capacity by around 5% and says it expects the change to have a limited effect on housing credit growth.

“Given some borrowers are already constrained by the floor rates that lenders use, and that many borrowers don’t borrow at their maximum capacity, the overall impact on aggregate housing credit growth flowing from this is expected to be fairly modest,” said APRA.

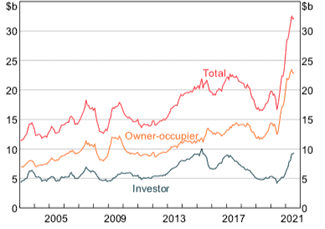

By borrower type, the regulator expects investors to feel greater impact than owner-occupiers because they typically borrow at higher levels of leverage. “On the other hand, first homebuyers tend to be under-represented as a share of borrowers borrowing a high multiple of their income as they tend to be more constrained by the size of their deposit.”

Figure 2: Housing loan commitments

Source: Reserve Bank of Australia Chart Pack, October 2021

But first homebuyers will bear the brunt of a higher serviceability buffer, according to Housing Industry Association Chief Economist Tim Reardon.

“First homebuyers are the group who are typically constrained by serviceability thresholds. It is this group that will be hit the hardest by these changes,” he said in a report.

“Restricting access to credit for new households seeking to enter the housing market will put further downward pressure on the rate of home ownership in Australia.”

More policy changes likely

While the new curb is expected to slow the housing market, APRA said it’s not aiming to temper dwelling prices, which are rising at their fastest annual growth rate in more than 30 years.

“Rather, APRA’s objective is to ensure that mortgage lending is conducted on a prudent basis, and that borrowers are well equipped to service their debts under a range of scenarios,” said the regulator.

But many housing market observers believe this is not the end of regulatory efforts to take the heat out of the property market.

“In the context of the current strength of the housing market, this is a modest change,” said David Plank, ANZ Bank’s Head of Australian Economics. “As such, further macroprudential tightening seems more likely than not.”

Brokers can help

Changing regulations tend to make applying for a housing loan complicated, including for small business owners who are looking to use their home equity to fund their businesses. To navigate these challenges, many individuals are turning to expert mortgage brokers.

The number of borrowers using brokers has also risen during the COVID-19 pandemic as some lenders have tightened their home loan policies. Data from the Mortgage and Finance Association of Australia (MFAA) shows that housing loans settled by brokers between October 2020 and March 2021 rose more than 24% year on year to reach a record of $122.8 billion.

The number of mortgage brokers also increased to 16,968 during the period, up by more than 470.

“Mortgage brokers were able to assist a record number of customers in taking advantage of the historically low interest rates and strength in the market, and in doing so achieved some of their most positive results to date,” said MFAA CEO Mike Felton.