Australia’s housing sector is poised for modest price growth in 2025. Will this create opportunities or challenges for those looking to enter the market?

According to PropTrack’s Property Market Outlook, national home prices will rise between 1% and 4% in 2025. This is slower than the 5.5% growth seen in 2024, as high interest rates, increased property listings and affordability issues combine to temper demand.

“With the rate of price growth slowing and interest rates expected to remain higher for longer, along with more properties coming to market for sale, it appears 2025 is set for weaker price growth than over recent years,” said Cameron Kusher, PropTrack’s Director of Economic Research.

The upcoming federal election may also influence the housing sector, as typically seen in the lead-up to an election. “[It] could contribute to a slower than normal housing market early in 2025,” added Kusher.

Regional variations

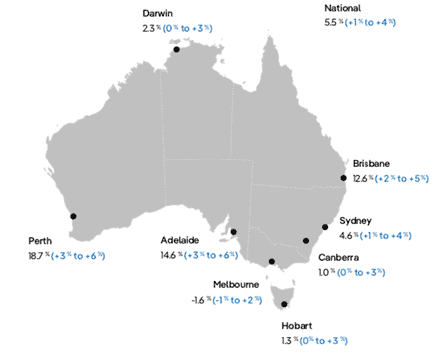

But the pace of price changes will vary across cities.

PropTrack expects Perth to lead with a 3–6% growth after a massive increase of 18.7% in 2024. Adelaide and Brisbane could see similar growth ranging from 2% to 6%.

In contrast, Sydney and Melbourne are forecast to grow modestly by 1% to 4% – and Hobart, Canberra and Darwin between 0% and 3%.

Price growth in 2024 (and 2025 forecast)

Note: The 2024 price growth is from January to November 2024.

Source: PopTrack, Property Market Outlook, December 2025

Buyers in major cities may benefit from the high number of homes still on the market.

“Most capital cities have been seeing new listing volumes trending higher throughout 2024 as vendors’ willingness to put properties up for sale has increased,” said Kusher. “Sydney and Melbourne are currently seeing total listing volumes at highs not seen in more than a decade.”

Interest rate cuts on the horizon

While reductions in the official cash rate could re-energise the market, the timing of these cuts remains uncertain. It depends on factors such as inflation trends, Australia’s economic performance and global developments, according to Ray White’s Chief Economist Nerida Conisbee.

In particular, Donald Trump’s return to the White House may introduce new economic uncertainties. “[It] will boost government spending and put high taxes on Chinese goods,” said Conisbee. “This could push up prices worldwide, including in Australia, making it harder for the RBA [Reserve Bank of Australia] to cut rates.”

Australia’s economic health is another factor. “If people start spending less in shops, house prices fall significantly or unemployment begins to rise, the RBA might need to cut rates sooner than planned,” added Conisbee.

But she expects the RBA to stick to its careful approach. “This means making small, well-spaced cuts rather than rushing to lower rates quickly.”

Potential drivers of growth

Despite the cooling market, Conisbee believes Australia’s strong population growth could support home prices in 2025, particularly in Perth and Brisbane, where migration rates remain high.

The limited availability of new housing due to rising construction costs may likewise drive up prices. “The lack of new supply also means any excess demand can’t be easily met with new housing,” noted Conisbee.

Opportunity to buy

While there are broader supply constraints with new housing, the volume of existing inventory offers an opportunity for buyers.

“Assuming the higher volume of stock for sale persists, buyers will be afforded more choice when looking to purchase, likely reducing competition and urgency from buyers,” said Kusher.