Australia’s housing market defied expectations in 2023. Despite the cash rate spiking five times to a 12-year high, home values didn’t dip. Instead, they kept climbing, driven by a shortage in supply and a growing population in need of housing.

What’s next for the market now that the Reserve Bank seems to have reached the peak of its interest rate increases?

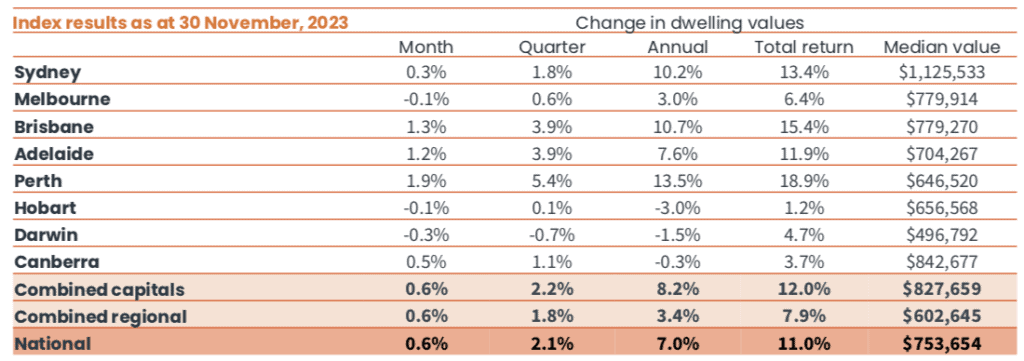

Figure 1: Growth in housing values, November 2023

Source: CoreLogic Home Value Index, November 2023

If the November figures are any indication, growth in housing prices might be starting to moderate. Data from CoreLogic shows that national home values recorded a monthly rise of 0.6%, the slowest monthly increase since the upward trend began in February 2023. In capital cities, Melbourne and Hobart declined by 0.1% and Darwin by 0.3%, while Sydney’s growth slowed to 0.3%, marking its smallest monthly gain in the past 10 months.

Likewise, industry observers predict housing market growth to soften in 2024.

According to Jo Masters, Chief Economist at financial services firm Barrenjoey, housing supply is again playing an important role in shaping current market cycle dynamics. “As supply lifts but interest rates hold at [the current] levels, it wouldn’t surprise me if you start to get a bit of softening coming through,” she says.

SQM Research Managing Director Louis Christopher predicts that 2024 housing prices will either remain flat or decline in most cities, except Perth and Brisbane. In his ‘base case’ forecast, he expects prices to move within the range of -1% to 3% across the country.

“The sharp deterioration of housing affordability, driven by ongoing interest rate rises which are now, in SQM’s opinion, at restrictive levels, plus an anticipated slower economy, will see a modest to moderate correction in dwelling prices take place in Sydney, Melbourne, Canberra and Hobart,” says Christopher. “Adelaide and Darwin are anticipated to remain steady or record a minor rise or correction.”

He adds that SQM “expects a rise in distressed selling activity over [the] next year, and [with] only the most cashed up willing to enter the market”.

Limited housing construction, strong demand

However, the drivers of this year’s housing price increases – particularly limited supply and population growth – are likely to persist in 2024.

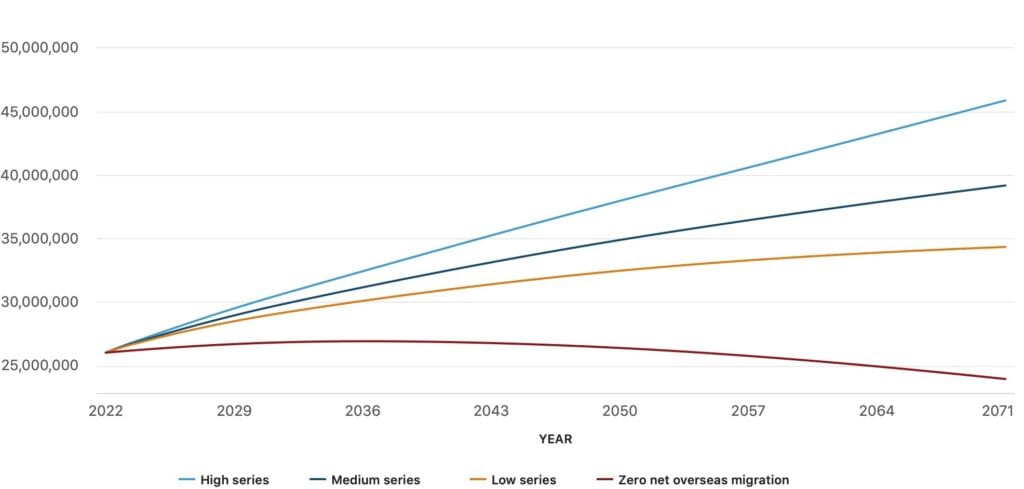

In a series of projections by the Australian Bureau of Statistics, the population is forecast to grow annually by more than 522,000 in 2023 and by over 436,000 in 2024, potentially sustaining high demand for housing.

Figure 2: Australia’s projected population

Source: Australian Bureau of Statistics, Population Projections 2022–2071

Real estate appraiser PropTrack also foresees constrained new housing development in 2024.

“We expect that a combination of continued strong demand and limited new housing construction will contribute to price gains, albeit at a slower pace than we experienced this year,” says PropTrack Director of Economic Research Cameron Kusher.

The company anticipates price growth of 1% to 4% in 2024 and notes the potential for future increases in the cash rate, which could impact buyer and seller sentiment.

“Stage three tax cuts will commence in July, which will benefit higher-income earners, and in turn, could lead to increased demand for higher-priced housing,” adds Kusher.

Uncertain outlook

Given the many push and pull factors at play, Domain believes the outlook for the property market in 2024 is uncertain.

“Stretched affordability and lower borrowing power will continue to place a ceiling on buyers’ capacity to pay for a home,” says Domain Chief of Research and Economics Nicola Powell. “We could see measures that improve this outlook for buyers in 2024.”

However, actions such as a reduction in interest rates or easing the mortgage serviceability buffer could spur demand and lead to an upswing in housing prices.

“Once we start to see interest rates being cut, it’ll feed into improved consumer sentiment, and once that starts to rise, we’ll likely see increased housing activity occur,” says Powell. “And that is expected to happen in late 2024.”