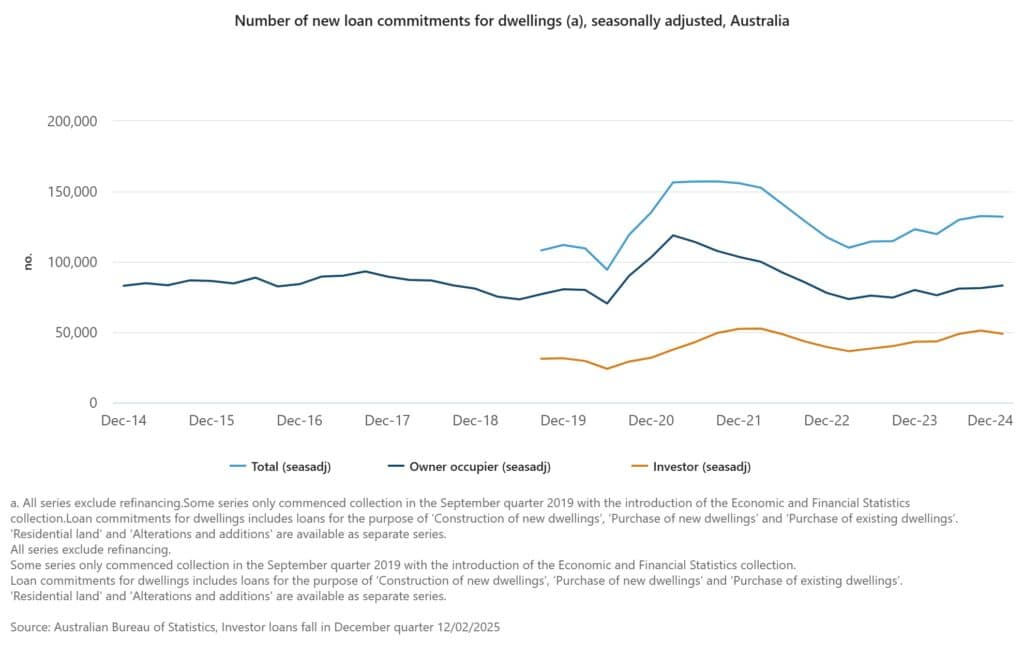

The number of new loan approvals to property investors has fallen for the first time in almost two years, according to data from the Australian Bureau of Statistics (ABS).

As higher borrowing costs and cooling values in some state capitals affect the outlook for residential property, investors are deciding whether to hold off on purchasing or look for value elsewhere.

A 25-basis-point interest rate cut, announced at the Reserve Bank of Australia’s February meeting, could be all it takes to shift sentiment back in property’s favour.

For the three months to 31 December 2024, the number of new investment loan approvals for dwellings fell 4.5% from the previous quarter to 48,876.

It was the first fall since March 2023.

Regional price growth variations

Investors have had to keep track as property values around the nation’s capitals followed different paths last year.

Price data for 2024, collated by CoreLogic, showed some markets fared much better than others. Strong annual gains in median property values for Perth (up 19.1%), Adelaide (13.1%) and Brisbane (11.2%) were tempered by middling growth of 2.3% in Sydney and a fall of 3.0% in Melbourne.

As sales results were tallied throughout the year and forecasts revised, investors decided the time was right to get in. The mood changed late in the year.

Strong year for lending

Property is still a favoured asset class among Australian investors, and last year, they chose to increase portfolio allocations, with sharp rises in loans in Western Australia (up 55.9% year on year), Queensland (up 40.9%), South Australia (up 40.7%) and New South Wales (up 29.3%).

Total lending to property investors in the December quarter fell 2.9% to $32.4 billion from a record $33.4 billion in the September quarter. According to ABS data, the average loan size rose by $25,065 to $674,316.

Lenders meet demand

Although the tail end of 2024 saw a cooling off, it was still a strong year for lenders.

“Despite the December quarter fall, the value of new investment loans during the 2024 calendar year in original terms reached $125.1 billion,” said Mish Tan, head of finance statistics at the ABS. “This was 29.8% higher than the $96.4 billion value of new loans in 2023.”

Last year the average property investment loan increased by 7.9%, Tan said.

Investors have faced rising borrowing costs over the past three years as the RBA lifted the target cash rate 13 times, from 0.1% in May 2022 to 4.35% in November 2023.

Rising costs crimped borrowers’ enthusiasm. Investor loan volumes dropped from $32.6 billion for the March 2022 quarter to $22.3 billion a year later – a more than 31% fall.

Interest rate cut and demand for credit

Borrowers have been anticipating lower costs as the central bank has acted to bring inflation down from a high of 7.8% in December 2022.

The strategy worked, and at its February meeting, the RBA lowered the cash rate target from 4.35% – a level it had kept since November 2023 – to 4.1%.

As lenders pass on the rate cut, borrower enquiries are expected to rise once again as repayments for investment property – never out of favour – become relatively more affordable.

Since 2019, quarterly approvals for investment property loans have not beaten the peak of 52,581 that was set in March 2022.

Average loan size grows

“Investor loans have driven over half of the total growth [in finance for all dwellings] over the past year, despite accounting for a little over a third of total loans,” Westpac economist Neha Sharma wrote in a note to clients.

Now that rates have been reset lower for the first time since November 2020, with the possibility of more to come, investors are expected to book appointments with lenders again.

“Looking ahead, with home buyer sentiment improving over the past six months [and following the RBA decision to lower rates], it’s highly likely that the up-turn that’s been in place since early 2023 stays in motion,” Sharma wrote.